Simplify Your Taxes With a Clear System Built for Home-Based Entrepreneurs

Get organized. Feel confident all year long.

Getting Confusing or Bad Advice?

Owing More Than Expected?

Feeling Disorganized & Unprepared?

Dreading Tax Season Every Year?

Worried About Being Audited?

It doesn’t have to feel this way. You need a proven, simple system designed for home-based entrepreneurs that keeps your records organized and your tax filing clear.

Why Taxes Get So Complicated for Home-Based Entrepreneurs

For many home-based entrepreneurs, bookkeeping and tax filing lack a clear system. When there is no system, tax season gets complicated.

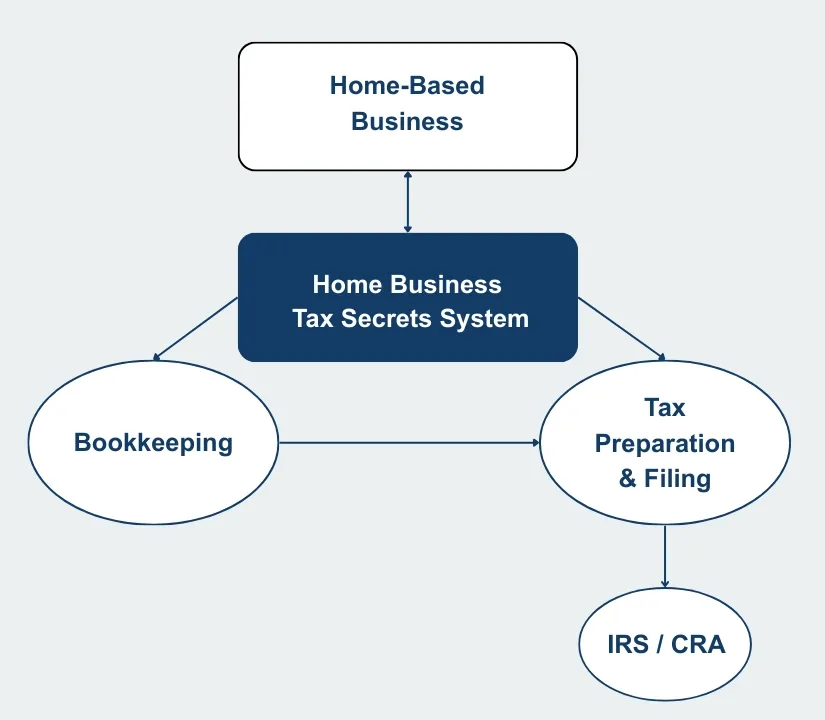

The Home Business Tax Secrets Three-Step Foundation connects bookkeeping, tax preparation, write-offs, and compliance into one clear path designed for home-based businesses.

A Proven System Designed for Home-Based Entrepreneurs

The Home Business Tax Secrets System is a proven path that replaces guessing with clarity, shows you exactly how to stay organized, and builds confidence at tax time.

The Three-Step Foundation of the Home Business Tax Secrets System

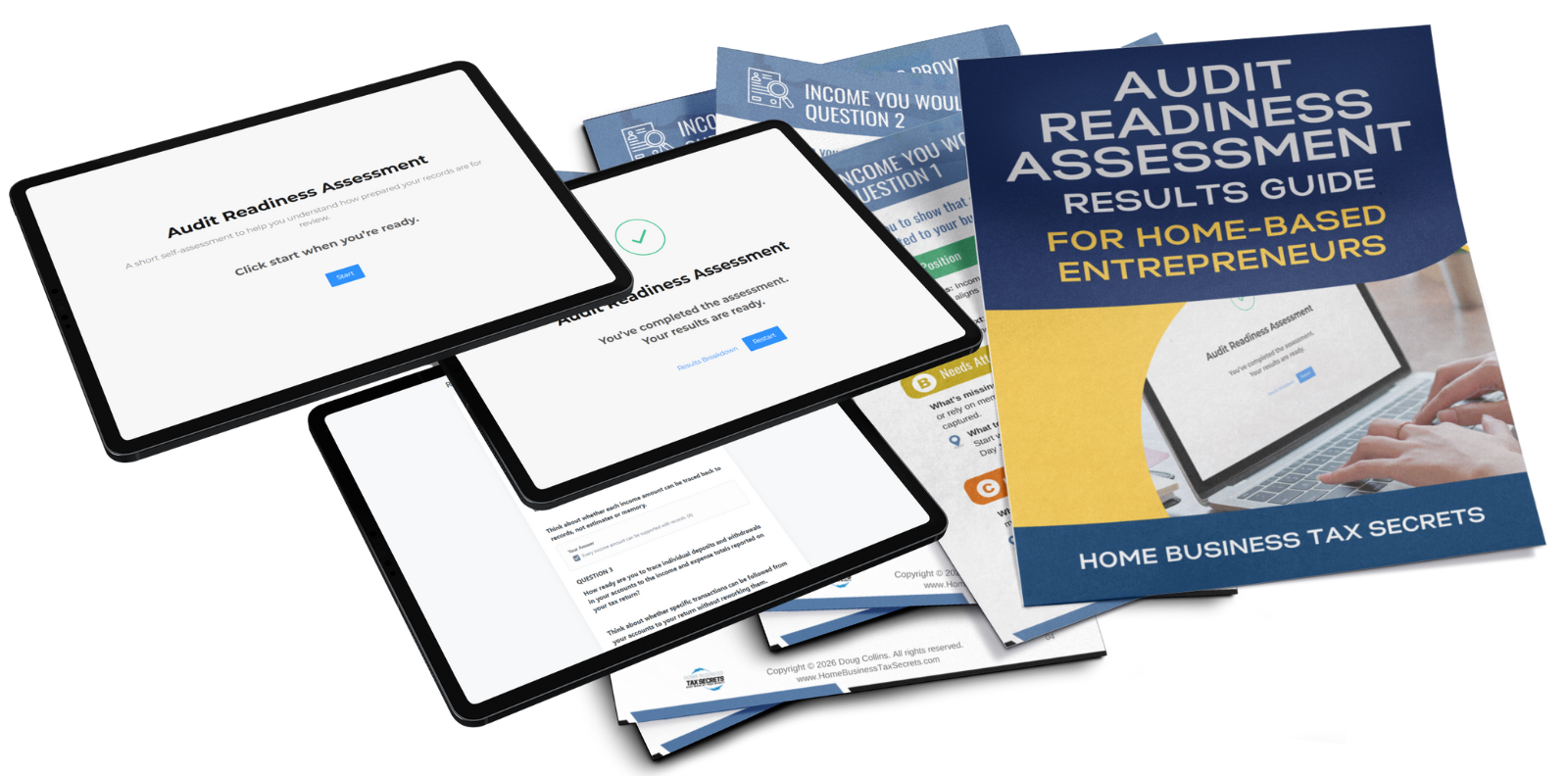

Audit Readiness Assessment

The first step inside the Home Business Tax Secrets System is understanding where you truly stand.

The Audit Readiness Assessment gives you a clear snapshot of your business today and shows you exactly what to improve next, so you move forward with direction instead of guessing.

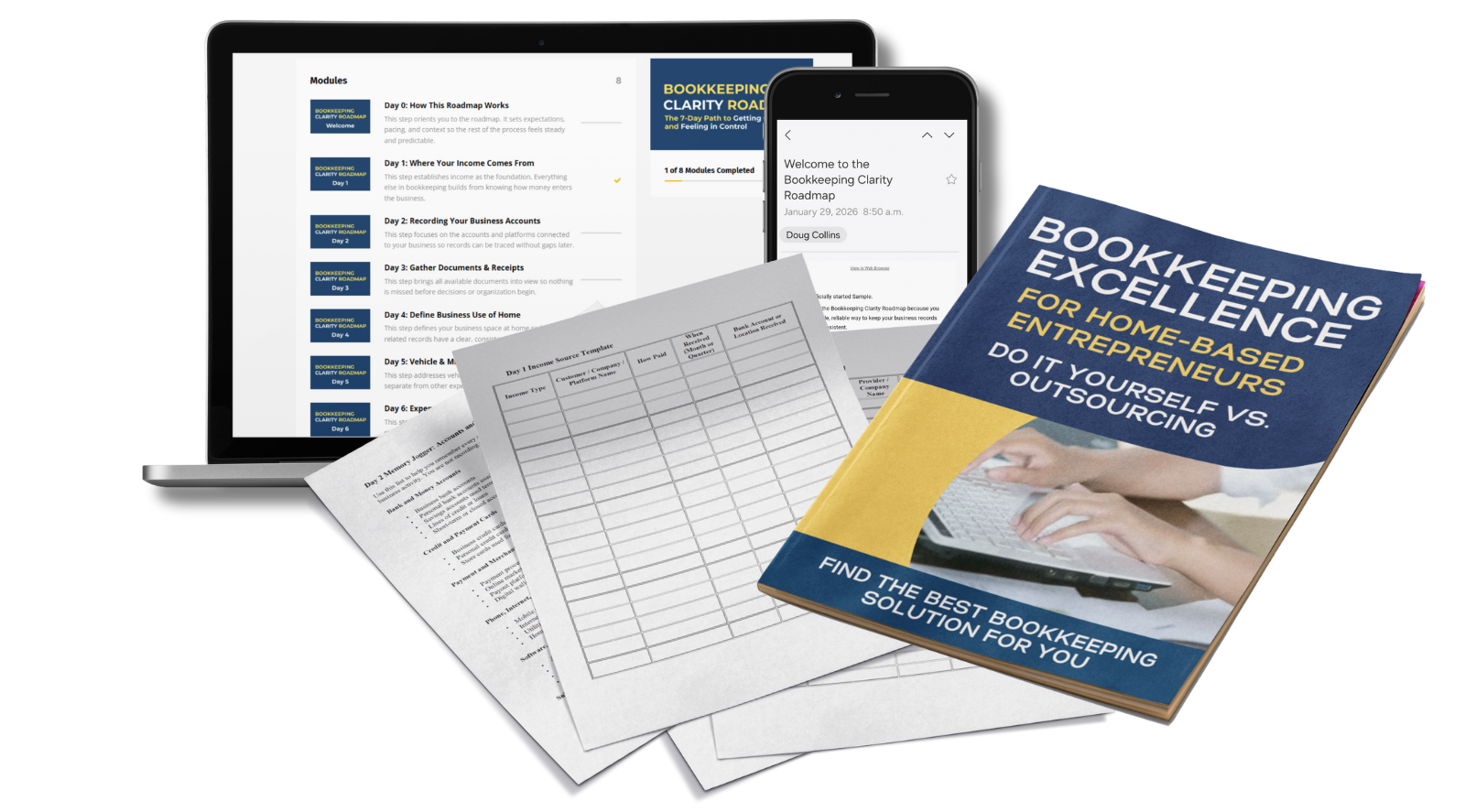

Bookkeeping Clarity Roadmap

Once you know where you stand, the next step is getting your bookkeeping organized.

The Bookkeeping Clarity Roadmap gives you a clear system for keeping your income and expenses in order, so you are never scrambling or wondering if you missed something. This is not software training. It shows you what clean records look like so you can use a simple method that works for you.

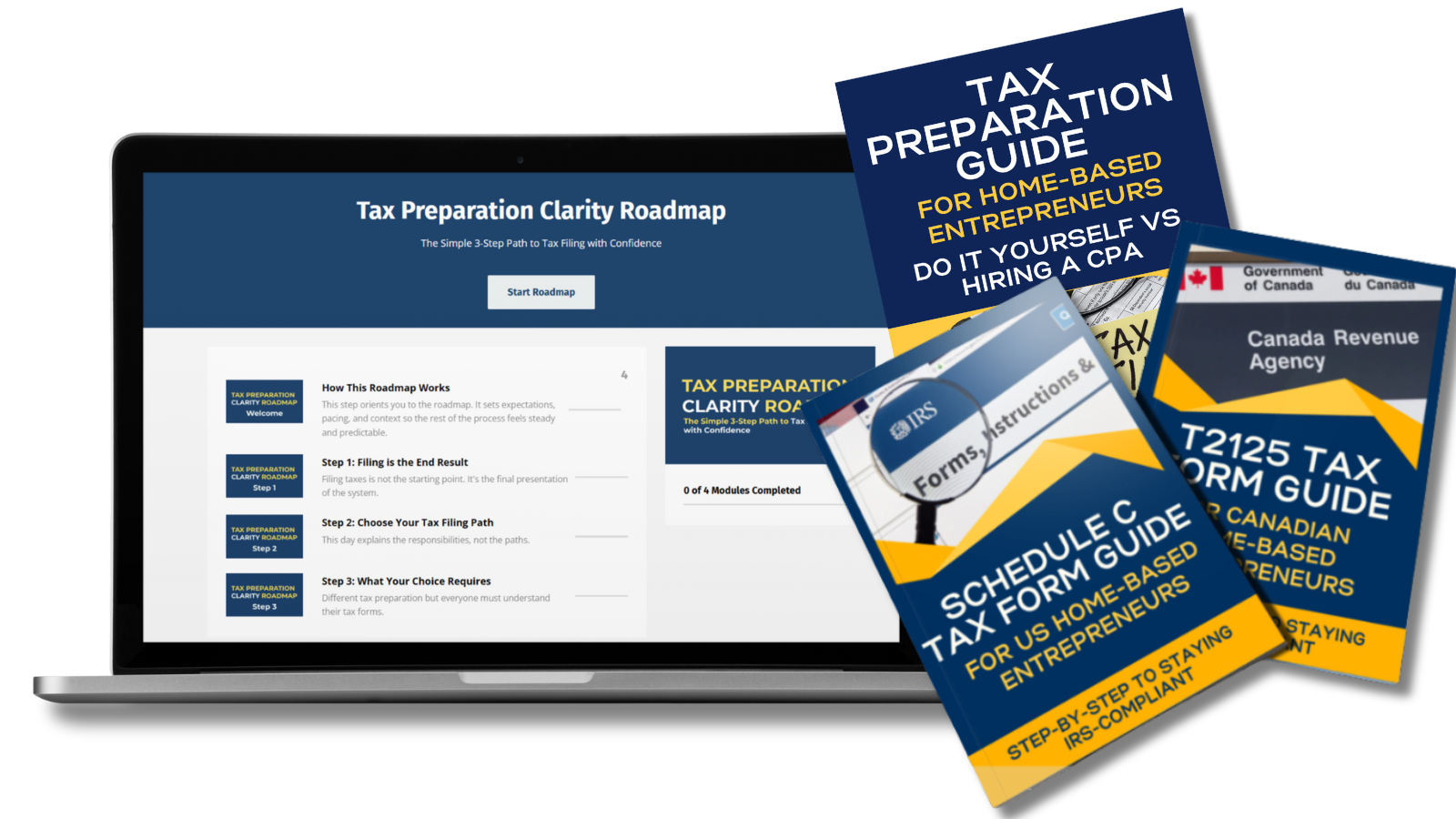

Tax Preparation Clarity Roadmap

Once your bookkeeping records are organized, tax season no longer feels overwhelming.

The Tax Preparation Clarity Roadmap shows you how your bookkeeping connects to your tax return, so you understand what matters, what to review, and what you are filing before you submit.

These three steps are the foundation of the Home Business Tax Secrets System. Everything that follows reinforces that structure and strengthens your documentation.

Ongoing Support for your Home-Based Business

Tax Write-Offs Made Simple Course

The Tax Write-Offs Made Simple course is built specifically for home-based entrepreneurs and focuses on what you can legally claim. The course covers write-offs, audit red flags, documentation standards, expense tracking, and reinforces the importance of planning ahead before tax filing.

The course includes a practical workbook and bookkeeping Excel templates for those who choose to follow a spreadsheet-based simplified bookkeeping system.

This course applies to both Canadian and U.S. home-based entrepreneurs and is supportive whether you use spreadsheets, accounting software, or work with a tax preparer.

Community Hub

Inside the Home Business Tax Secrets Community Hub, you receive ongoing support throughout the year, including regular weekly updates and monthly government tax updates.

You have access to live Office Hours where you can ask questions and get clear answers in real time. This ongoing support helps you stay organized and move forward with confidence.

Practical Guides for Common Risk Areas

You also receive focused guides that address common audit risk areas for home-based entrepreneurs.

These standalone guides provide clear explanations and practical documentation guidance for business travel, meal write-offs, and GST/HST registration and filing (Canada).

Each guide explains what qualifies, what documentation is required, and how to avoid common mistakes. Use them as references whenever you need clarity in a specific area.

Home Business Tax Secrets System

$79 USD/month

($89 CAD/month)

What's Included:

- Audit Readiness Assessment

- Bookkeeping Clarity Roadmap

- Tax Preparation Clarity Roadmap

- Tax Write-Offs Made Simple Course

- Member Community Hub

- Guide Downloads (Meals, Travel, GST)

- Access to New Guides and Tools

100% Tax Deductible

Instant Access | Cancel Anytime

What Happens When the Structure Is Followed

Simple Systems Close the Home-Based Business Tax Gap

Charmaine - Travel Agent

Three years of receipts in a box. No clear starting point. Organized month by month using a structured tracking process. Backlog removed. Filing completed. $3,200 tax refund received.

Jackie - Home Renovations

Filing stopped after seeing a $4,000 balance owing. Started monthly tracking using spreadsheet course. Filed independently. $3,000+ tax refund.

Alysa - Clinical Counsellor & Coach

Collected receipts. No consistent monthly tracking. Used the monthly tracking system in the spreadsheet course. Filed independently. $26,000 in tax refunds across two businesses.

Simple systems work when they are followed.

This System is for the Home-Based Owner Who Currently…

-

Receives conflicting tax answers from different sources.

-

Saves receipts without consistent tracking.

-

Starts bookkeeping but does not maintain it.

-

Pays for tax services without clear understanding.

-

Files tax returns without reviewing what was submitted.

-

Claims write-offs without solid documentation.

If this describes your current situation, this is the right place to start.

Home Business Tax Secrets System

$79 USD/month

($89 CAD/month)

What's Included:

- Audit Readiness Assessment

- Bookkeeping Clarity Roadmap

- Tax Preparation Clarity Roadmap

- Tax Write-Offs Made Simple Course

- Member Community Hub

- Guide Downloads (Meals, Travel, GST)

- Access to New Guides and Tools

100% Tax Deductible

Instant Access | Cancel Anytime

Built From Real Home-Based Business Experience

Created by someone who has run a home-based business since the late 1990s.

The Home Business Tax Secrets System was built from years of working through my own bookkeeping confusion and watching the same disconnect repeat across other home-based businesses.

The Three-Step Foundation did not come from textbooks or tax theory. It came from refining what actually works for home-based entrepreneurs.

Still Have Questions?

Quick answers to common questions before you join.

You’re not alone. Most members had the same questions before joining. Once inside, they quickly realized how much easier it is to stay organized, save more, and feel confident all year long.