The Home-Based Business Guide to Write Off Almost Anything

Finally Understand What You Can Write Off Saving Thousands

It’s a Shame to Pay More Income Tax Than Necessary

If you’ve ever felt overwhelmed or confused by home business taxes, this book is for you. In this updated and expanded second edition, you’ll discover overlooked write-offs and proven strategies that help home-based entrepreneurs save money with confidence.

Written for both U.S. and Canadian readers, the book simplifies tax rules so you can finally stop second-guessing and start keeping more of what you earn.

Inside the book, you’ll learn:

How to uncover write-offs most home-based entrepreneurs miss

• Simple ways to reduce stress and stay organized all year

• How to combine part-time business with a full-time job to maximize savings

• Why relying only on a tax preparer can leave money on the table

• Practical steps to audit-proof your business with straightforward records

This isn’t a line-by-line tax manual. Instead, it gives you a clear, approachable system to identify, claim, and maximize your home business write-offs.

Who This Book Is For

This book is written for home-based entrepreneurs of all kinds, including freelancers, contractors, coaches, course creators, affiliate marketers, direct sellers, network marketers, real estate investors, and gig economy workers such as rideshare and food delivery drivers.

It’s also perfect for anyone with rental income, side hustles, or those preparing for audits, exploring legal structures, or reviewing insurance needs.

What Makes This Book Different

✓ Written in plain language for everyday entrepreneurs, not accountants

✓ Cuts through online myths so you can trust the guidance

✓ Offers strategies you can apply right away

✓ Includes free digital tools to help you take action and stay organized

Stop letting confusion or procrastination cost you thousands.

Get the book today and take control of your home business taxes with clarity and confidence.

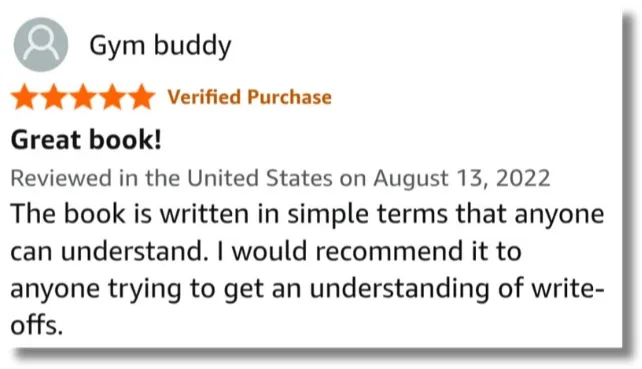

These Reviews Speak for Themselves…

What Real Readers Are Saying About the Home Business Tax Secrets Book

These are real Amazon reviews from real readers—many of whom weren’t tax-savvy when they started.