It’s a Shame to Pay More Income Tax Than Necessary

Home-Based Business Owners Miss Thousands in Legitimate Tax Write-Offs Every Year

Confusing advice, messy records, and disconnected bookkeeping cause many home-based entrepreneurs to miss legitimate tax write-offs.

Getting Confusing or Bad Advice?

Owing More Than Expected?

Feeling Disorganized & Unprepared?

Dreading Tax Season Every Year?

Worried About Being Audited?

The Home Business Tax Secrets System helps you get organized, claim your write-offs, and approach tax season with confidence.

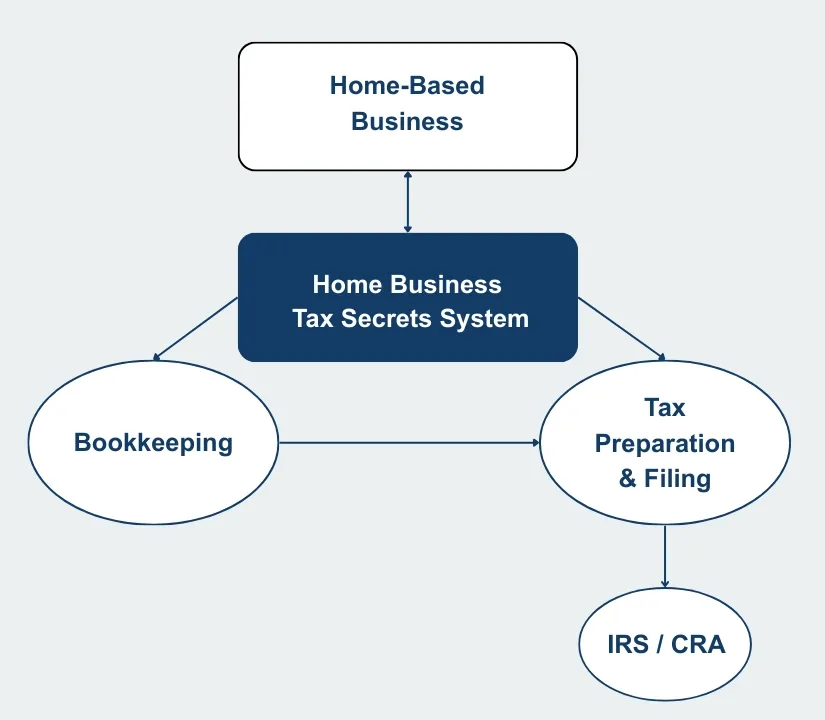

How the Home Business Tax Secrets System Connects It All

Why So Many Tax Write-Offs Get Missed Every Year

When bookkeeping, write-offs, and tax filing are handled separately, the same situations show up year after year.

- Rebuilding records at tax time

- Paying tax preparers to sort through receipts

- Missing legitimate write-offs

- Second-guessing numbers before filing

How Most Home-Based Entrepreneurs Handle This

Home-based entrepreneurs usually handle this one of three ways: they manage the bookkeeping and taxes themselves, outsource the work to a bookkeeper or tax preparer, or fall behind and try to sort it out later.

What is missing is guidance on what qualifies as a write-off, how it should be documented, and how those numbers connect to the tax return.

This is exactly the gap the Home Business Tax Secrets System was designed to close.

The Three-Step Foundation of the Home Business Tax Secrets System

These three steps form the foundation of the Home Business Tax Secrets System. Everything inside the membership builds on this structure.

What Happens When the System Is Followed

Here are a few examples of what can happen when home-based entrepreneurs apply structure to their bookkeeping and taxes.

This is what happens when bookkeeping, write-offs, and tax filing follow a clear structure.

Built From Real Home-Based Business Experience

Ongoing Guidance for Your Home-Based Business

This System is for the Home-Based Entrepreneur Who Currently

-

Receives conflicting tax advice from different sources.

-

Saves receipts but does not track expenses consistently.

-

Starts bookkeeping systems but does not maintain them.

-

Pays for tax preparation without fully understanding the numbers.

-

Files tax returns without reviewing what was submitted.

-

Files tax returns using software but is unsure the numbers are right.

-

Claims write-offs without strong documentation.

If this describes your current situation, this is the right place to start.

Home Business Tax Secrets System

$79 USD/month

$89 CAD/month

What's Included:

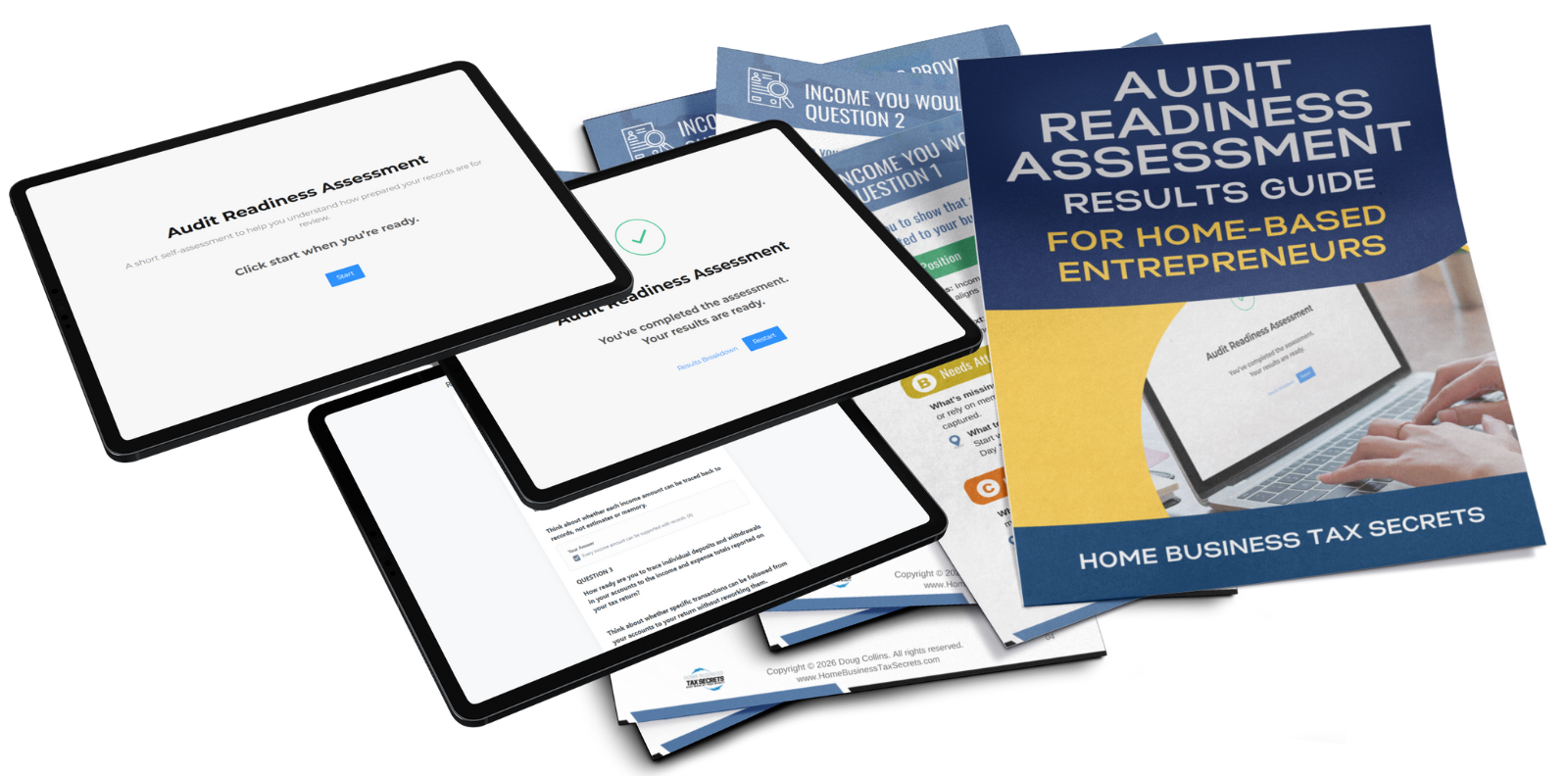

- Audit Readiness Assessment

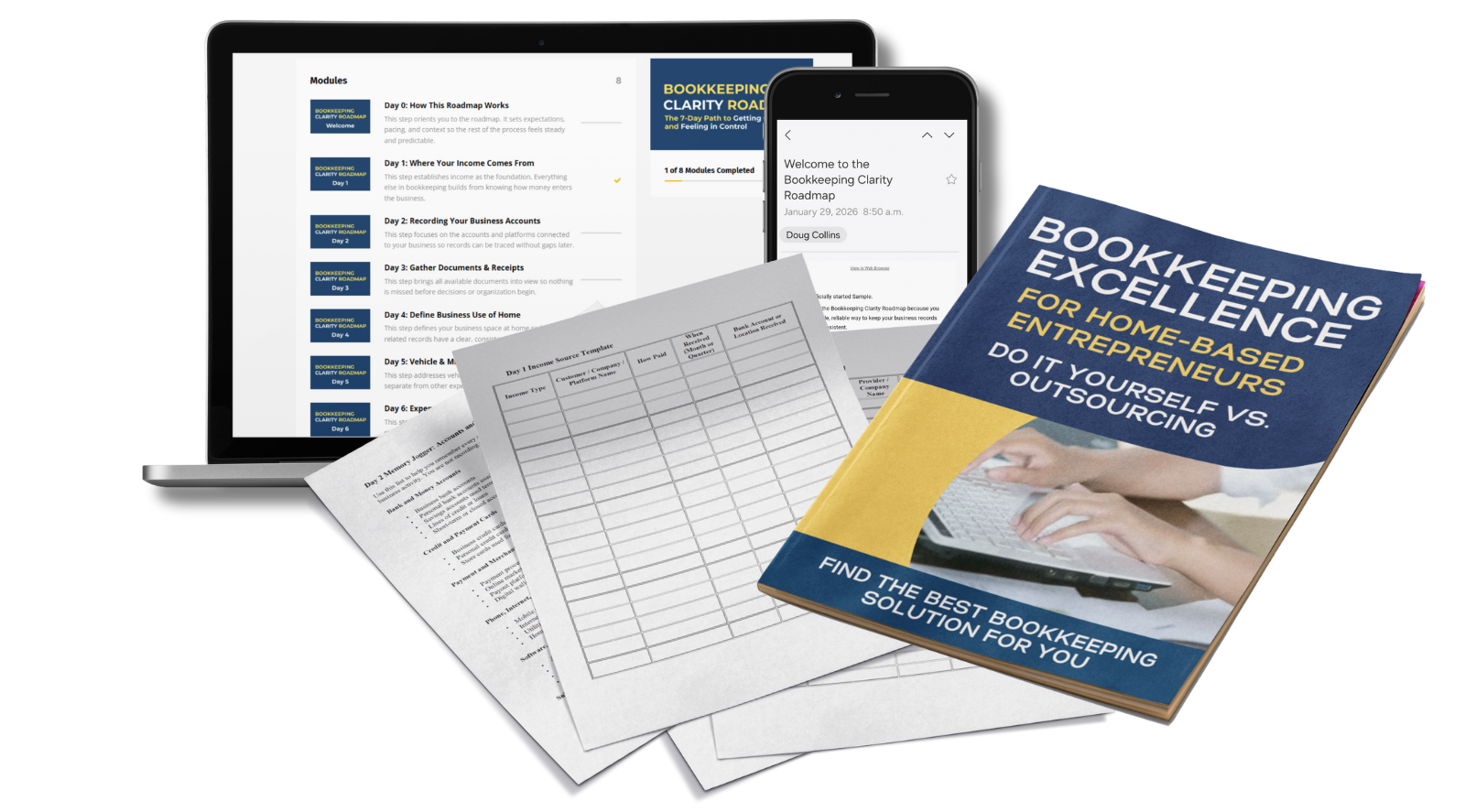

- Bookkeeping Clarity Roadmap

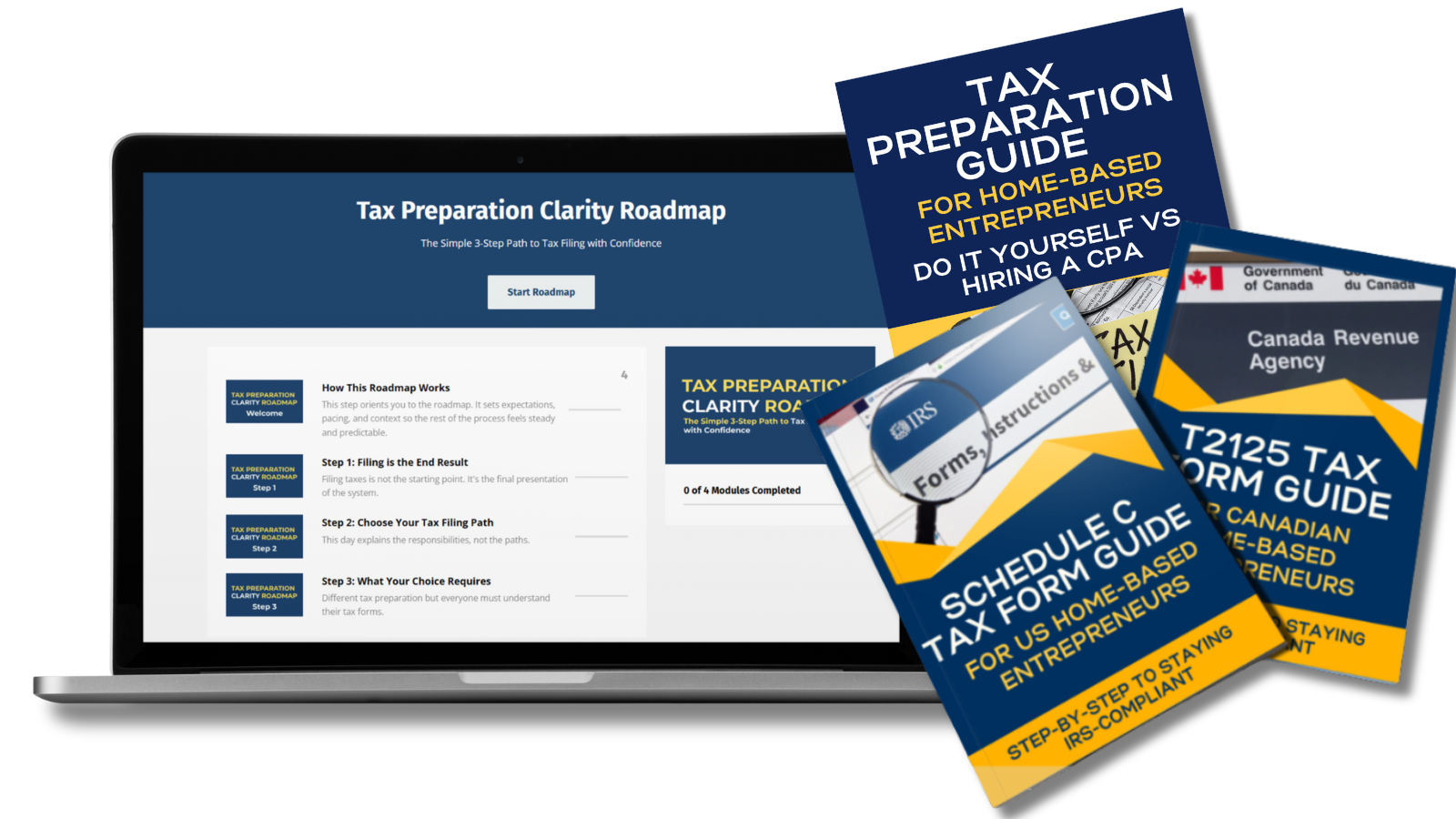

- Tax Preparation Clarity Roadmap

- Tax Write-Offs Made Simple Course

- Guide Downloads (Meals, Travel, GST)

- Member Community Hub

- Access to New Guides and Tools

100% Tax Deductible Business Expense

Instant Access | Cancel Anytime

Still Have Questions?

Most people have a few questions before getting started. These answers will help you understand how the system works and what to expect.