Why Taxes Feel So Complicated for Home-Based Entrepreneurs

If taxes make you feel stressed, unprepared, or buried in paperwork, you’re not alone.

Most home-based entrepreneurs are trying to keep receipts, track expenses, and make sense of tax rules that were never explained clearly.

Maybe you’re not sure what counts as a legit business write-off. Maybe you’ve been afraid of doing it wrong, so you avoid deductions altogether.

Or maybe you’ve searched online, only to find conflicting advice that leaves you more confused than when you started.

You might be thinking, I’m not a numbers person. I just want to avoid mistakes. I want a simple system that keeps me organized and audit-ready. The truth is, no one ever taught you how to manage taxes for a home-based business.

Most accountants only show up once a year to file your return, not to help you save more or stay organized all year long. That’s why so many entrepreneurs overpay, miss write-offs, and keep feeling stuck year after year.

You deserve a simple, repeatable system that gives you clarity, confidence, and control every tax season.

The Home Business Tax Secrets Community

Everything You Need to Keep More of What You Earn

Built by a home-based entrepreneur, for home-based entrepreneurs

A community membership platform created for home-based entrepreneurs who want to feel organized, confident, and audit-ready all year.

This isn’t just information. It’s the system I built after more than a decade helping home-based entrepreneurs stop overpaying and start understanding what they’re entitled to.

Step-by-Step Tax Strategy, Support & Education

One membership. All the support you’ve been missing.

When you join, you’ll get full access to:

- Tax Write-Offs Made Simple System Course – a complete, step-by-step system.

- Workbook & Quick References Guides – spreadsheets, walkthroughs, and organization tools.

- Monthly Live Office Hours & Events – informal, drop-in sessions where you can ask questions and get real-time help-no appointment needed

- Seasonal Tax Clinics (Dec–April) – structured, timely sessions to help you prep, file, and stay audit-ready during tax season.

- Private Member Community – ask questions and get feedback 24/7.

- Direct Q&A Support – email and text support to ask personalized questions.

- Exclusive Guide Library – bookkeeping, tax prep, vetting CPAs, and more.

This isn’t a one-and-done course. It’s an always-on support system to help you save more and stress less.

✓ 10-Module Step-by-Step 1 Hour Training

Learn at your own pace with lessons that simplify your most important write-offs and help you stay audit-proof.

Course Includes:

- Welcome and Course Downloads

- Home Business Tax Fundamentals

- Record Keeping & Being Audit Proof

- Home Office & Operating Expenses

- Vehicle Expenses & Business Mileage

- Meals & Entertainment Expenses

- Business Travel & Education

- Marketing & Advertising

- Inventory for Tax Purposes

- Plus 16 Bonus Videos

Available on desktop and mobile—learn at your own pace, anytime.

✓ Comprehensive Course Workbook

Your step-by-step companion to the video modules. This workbook is packed with:

- Guided checklists

- Practical examples

- Write-off planning worksheets

- Built-in action items to help you stay organized and audit-ready

Instant PDF download and available for purchase as a coil-bound color printed workbook ($39).

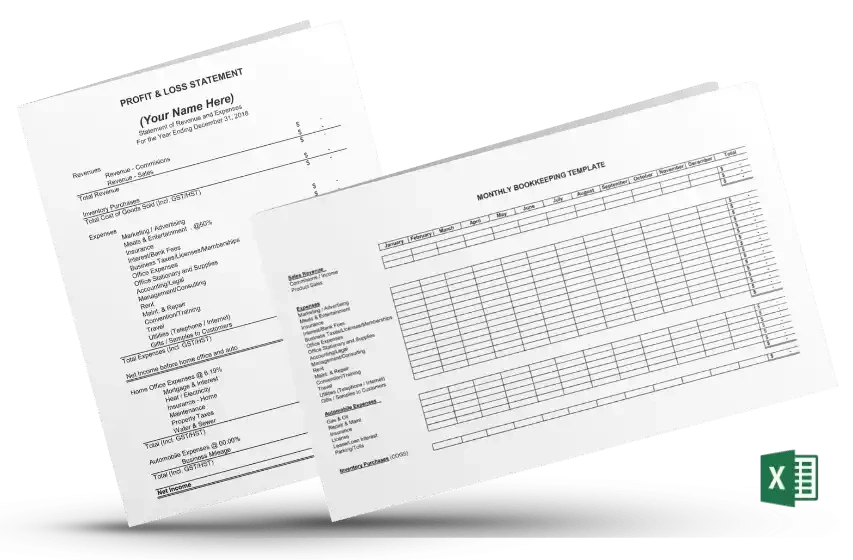

✓ Business Excellence Templates

These Excel Accounting templates were created for non-accountants. You’ll be able to:

- Track monthly income and expenses

- Easily print a Prepare a Profit & Loss statement

- Record receipts and keep digital audit trails

You don’t just get the tools you'll be able to following along on how to use them inside the online course system.

Library of Guides for U.S. and Canadian Home-Based Entrepreneurs

Get instant access to a full library of step-by-step guides on bookkeeping, tax preparation, hiring a CPA, and maximizing tax write-offs. Each guide is designed to make tax rules simple, so you can stop guessing, stay audit-ready, and keep more of what you earn.

- Bookkeeping Guide for Home Entrepreneurs: DIY bookkeeping options, software tools comparison, and when to outsource.

- Schedule C Guide (For U.S. Entrepreneurs): A step-by-step breakdown of IRS Schedule C, including deduction strategies & expense categories.

- T2125 Guide (For Canadian Entrepreneurs): A line-by-line guide to properly report income, deductions and expense categories.

- Tax Preparation Guide: DIY tax preparation versus hiring a CPA, how to vet and hire a CPA, avoid costly mistakes, including a hiring checklist.

- Audit-Proof Your Business Travel: Step-by-step guidance to travel write-offs that stand up to the IRS and CRA.

- Meal Write-Offs Made Simple: Turn everyday meals into tax write-offs without crossing the line.

- GST/HST for Home Businesses (Canada): Know when to register, how to collect, understand ITC, and how to report.

Real Stories. Real Savings.

How Alysa Turned Tax Dread into a $6,000 Refund.

Before joining, Alysa felt lost. Her accountant wasn’t explaining much, and every tax season brought anxiety and uncertainty.

After working through my system, here’s what changed:

- She uncovered $6,000 in overlooked write-offs in her first year

- She applied the same steps to her husband’s business and saved another $20,000

- She built confidence and now files her own taxes without fear or confusion

Her words say it best:

“Doug, you have a way of simplifying things that makes it easy for me to understand—and that’s why I trust you.”

Today, Alysa has all the tools and knowledge to be organized, audit-ready, and in full control of her home-based business finances. Her story isn’t an exception it’s what this community was built to deliver.

Hear What These Home-Based Entrepreneurs Are Saying

None of these individuals thought of themselves as “tax-savvy.” They just wanted to stop feeling overwhelmed, finally feel organized and confident. Here’s what happened when they got the right support.

"Totally impressed. Very easy to understand and to implement. This course was well worth the investment. The way I look at it, I came out the winner. This course was well worth the investment into my business and future." – RUDY ESCOBAR (USA) |

"Thanks Doug for all your help. Brian, I appreciate your patience and willingness to answer our many questions. The course is very well laid out. We like the video format and love the Excel monthly tracking sheets. So excited about the thousands of dollars we saved in taxes this year." – PATRICIA CREIGHTON (CANADA) |

"It's about time there's a course that helps people claim every right off they are entitled to as a home-based business. These strategies are golden. This will help everyone find their tax deductions more effectively." – DARLENE LONG (CANADA) |

"I found it easy to implement my numbers right along with the course. This was very educational for me. I will have better detailed record keeping to be audit proof and learned more about writing off home expenses!" – VERONICA JORDAN (USA) |

"I was never trained on what I could totally claim as expenses before this. It was easy to understand. I found the spreadsheets very helpful. It (tax season) will be a much smoother, less stressful process." – DEB MARSH (USA) |

"It (the course) was very clear and well organized. This coming year will be less stressful, much better organization and have a better impact on my return." – ENZO DIGIOVANNI (CANADA) |

"I would recommend Doug to anyone who needs extra help and support with their taxes. He really walked me through the whole process and I saved more than $2000 on taxes." – JACKIE LEE (CANADA) |

Home Business Tax Secrets Community Membership

ONLY $79 USD/Month

or $89 CAD/Month

Limited Time Offer: Join Now and lock-in the Founders Discount ($32/month savings).

What's Included:

- Tax Write Offs Made Simple Course

- Course Workbook

- Audit-Proof Financial Templates

- 24/7 Access to a Supportive Member Community

- Direct Access – Email and text support

- Seasonal Tax Clinics (Dec–April) – Monthly Filing Support & Live Q&A

- Exclusive Guides on Bookkeeping, Tax Preparation, Tax Forms and more.

Instant Access to Everything | No Long Term Commitment | Cancel Anytime

You don’t have to do this alone. You just need the right system-and the support to follow through.