Simplify Your Taxes and Keep More of What You Earn

A clear, proven system that helps home-based entrepreneurs stay organized, claim every legal tax write-off, and feel confident all year long.

Getting Confusing or Bad Advice?

![]()

Owing More Than Expected?

![]()

Feeling Disorganized & Unprepared?

![]()

Dreading Tax Season Every Year?

![]()

Worried About Being Audited?

![]()

You don’t need another accountant. You need a proven system that helps you take control, save more, and finally feel confident about your taxes.

Why Taxes Feel So Complicated for Home-Based Entrepreneurs

If tax season leaves you anxious, behind on paperwork, or second-guessing every expense, you’re not alone.

Most home-based entrepreneurs were never taught how to organize their finances or track tax write-offs properly. The result is confusion, stress, and missed savings that add up every year.

Maybe you’ve searched online, watched videos, or asked your accountant, only to end up more uncertain than before. You’re not lazy or careless, you just need a clear, repeatable system that works.

Inside the Home Business Tax Secrets Community platform, you’ll finally have a plan that keeps you organized, confident, and audit-ready without spending hours buried in receipts.

You’ll move from feeling stuck and stressed to feeling confident, organized, and saving thousands in taxes every year.

A Proven System That Turns Tax Stress into Confidence and Control

The Home Business Tax Secrets Community platform gives you the step-by-step system, mentorship, and support to simplify your taxes, track every expense, and finally feel confident about your numbers..

It’s designed for home-based entrepreneurs who want to stay organized, save thousands, and stop second-guessing what they can write off.

This is the same system I’ve used for decades to manage my own business. Inside, you’ll get practical tools, training, and a supportive community that helps you stay on track and audit-ready all year long.

When you join, you won’t be doing this alone. You’ll have a clear plan, hands-on support, and a growing sense of control that reaches every part of your business.

The Home Business Tax Secrets Community

Where clarity meets confidence, and support never ends.

Join a private member community designed to help home-based entrepreneurs simplify taxes, stay organized, and finally feel in control of their finances.

Here’s what you’ll experience inside:

-

Real answers to your tax and write-off questions so you stop guessing

-

Access to your full course, guides, and tools in one easy hub

-

Step-by-step onboarding that shows exactly what to do next

-

Office Hours and Q&A sessions for direct support

-

A community that celebrates progress and keeps you accountable

This isn’t another course. It’s your system for clarity, confidence, and year-round control.

Step-by-Step System, Support, and Education All in One Membership

Everything you need to stay organized, confident, and audit-ready every year.

Inside the Home Business Tax Secrets Community platform, you’ll get full access to the complete Tax Write-Offs Made Simple System, along with all the tools, templates, and guides that help you track expenses, claim every legal write-off, and finally feel in control of your numbers.

You’ll have direct support through live Office Hours, seasonal Tax Clinics, and a private member community where you can ask questions, get personalized answers, and learn from others who are following the same path.

You’ll also gain access to a growing library of exclusive resources on bookkeeping, tax prep, and professional vetting, all designed to help you stay organized and audit-ready throughout the year.

This isn’t just a course. It’s a proven support system that helps you save money, reduce tax stress, and become an Audit-Ready Entrepreneur who feels confident and in control all year long.

The Complete System That Turns Confusion into Confidence

Everything you need to simplify taxes, stay audit-ready, and finally feel in control of your business finances.

Whether you’re in Canada or the U.S., this course shows you exactly how to claim every eligible write-off, stay audit-ready, and finally feel in control at tax time.

✓ 10-Module Step-by-Step Course

Learn at your own pace through focused lessons that walk you through every area of your business finances. You’ll understand what to claim, how to stay organized, and how to maximize every legal tax write-off with confidence.

You'll discover:

- Home Business Tax Fundamentals

- Record Keeping & Audit Preparation

- Home Office & Operating Expenses

- Vehicle & Mileage Tracking

- Meals & Entertainment Write-Offs

- Business Travel & Education

- Marketing & Advertising

- Inventory for Tax Purposes

- Year-End Review & Planning

- Plus 16 bonus videos with real-world examples

Available on desktop and mobile so you can learn anywhere, anytime.

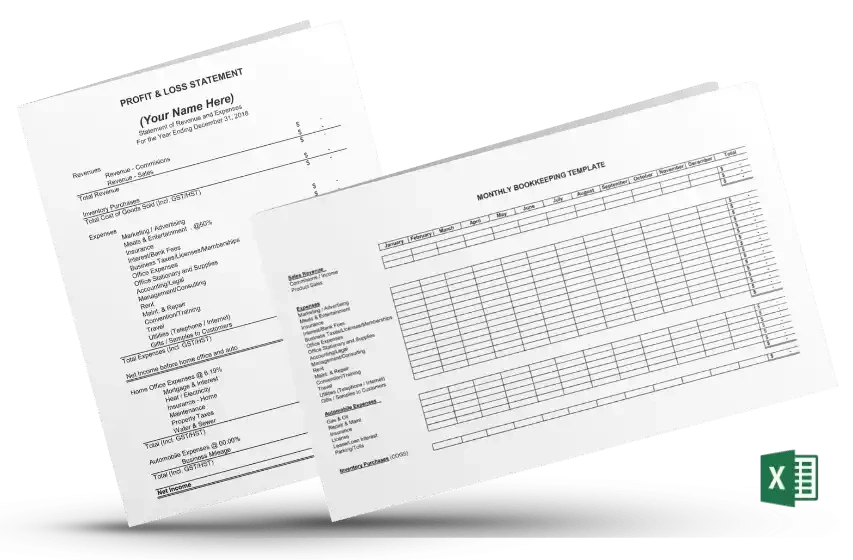

✓ Comprehensive Course Workbook

Your companion to the video modules, designed to help you stay organized and audit-ready. It includes checklists, examples, and worksheets that make learning practical. Download it instantly as a PDF or order the printed version if you prefer a physical copy.

So you always have a clear plan at your fingertips.

✓ Business Excellence Templates

These Excel templates make tracking income, expenses, and receipts simple. You’ll be able to record everything, generate reports, and keep a clean audit trail month after month.

Finally, a bookkeeping system built for non-accountants that keeps you on track all year long.

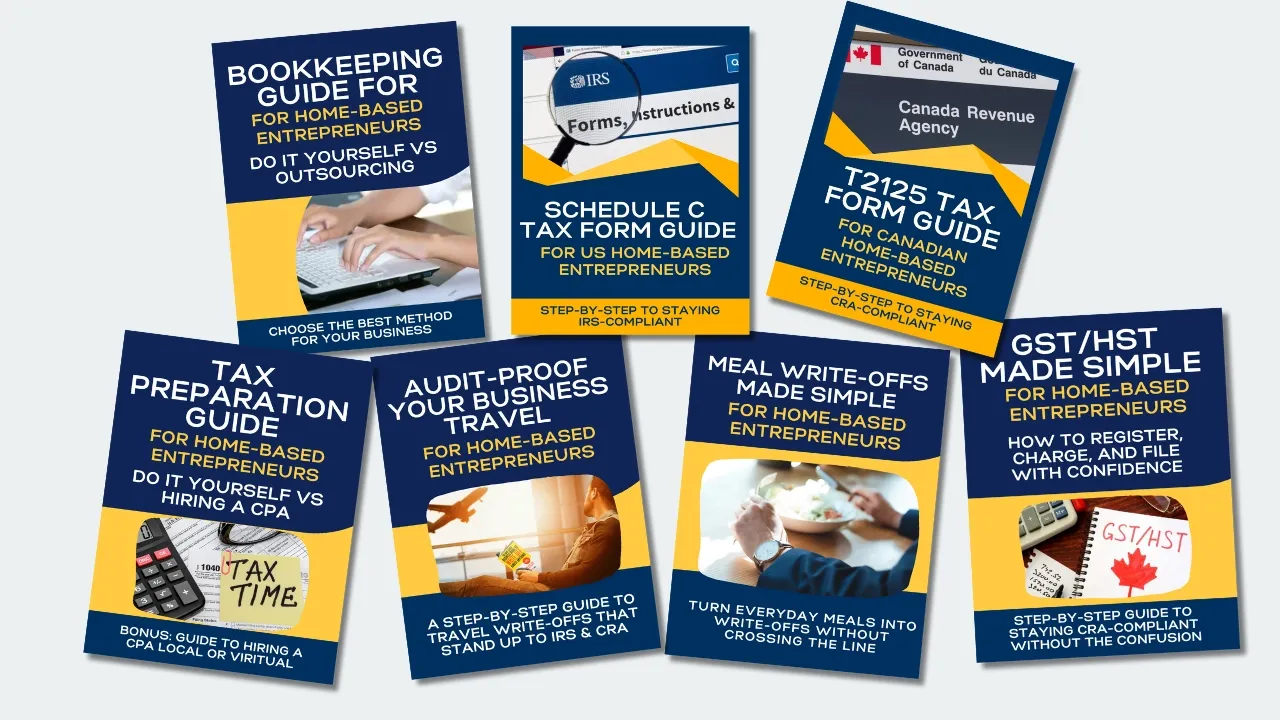

Exclusive Guide Library for Home-Based Entrepreneurs

Step-by-step guides that simplify complex tax topics and help you stay organized, compliant, and confident all year long.

Inside the Home Business Tax Secrets Community platform, you’ll get instant access to a library of practical guides covering every key area of your business taxes.

These are not generic downloads. They are created to help you take real action and stop second-guessing your write-offs. You'll get instant access to:

- Bookkeeping Guide for Home Entrepreneurs: Compare DIY and outsourced options so you can choose the best fit for your workflow.

- Schedule C Guide (U.S.): See exactly how to complete IRS Schedule C with real examples and category breakdowns.

- Tax Preparation Guide: Know when to file yourself, when to hire, and how to avoid costly filing errors.

- Audit-Proof Your Business Travel: Track, document, and justify travel expenses so they stand up under review.

- Meal Write-Offs Made Simple: Learn how to document meals correctly and save more at tax time.

- T2125 Guide (Canada): Understand how to properly report income and expenses for your small business.

- GST/HST for Home Businesses (Canada): Register, charge, and remit confidently while maximizing Input Tax Credits.

Each guide is exclusive to members, updated regularly, and created to help you get results, not just more information.

Real Stories. Real Savings.

How Alysa Turned Tax Dread into a $6,000 Refund.

Before joining, Alysa felt lost and anxious about tax season. Her accountant offered little guidance, and she never felt confident she was doing things right.

After working through my system, everything changed:

- She uncovered $6,000 in missed write-offs in her first year

- She applied the same steps to her husband’s business and saved another $20,000

- She gained confidence and now files her own taxes without fear or confusion

In her words she said:

“Doug, you have a way of simplifying things that makes it easy for me to understand, and that’s why I trust you.”

Alysa’s story isn’t unique. It’s what happens when home-based entrepreneurs finally have a clear system and ongoing support instead of trying to figure it all out alone.

Hear What These Home-Based Entrepreneurs Are Saying

Everyone starts from the same place: feeling overwhelmed, second-guessing their expenses, and tired of paying too much in taxes. Now they feel organized, confident, and in control.

"Totally impressed. Very easy to understand and to implement. This course was well worth the investment. The way I look at it, I came out the winner. This course was well worth the investment into my business and future." – RUDY ESCOBAR (USA) |

"Thanks Doug for all your help. Brian, I appreciate your patience and willingness to answer our many questions. The course is very well laid out. We like the video format and love the Excel monthly tracking sheets. So excited about the thousands of dollars we saved in taxes this year." – PATRICIA CREIGHTON (CANADA) |

"It's about time there's a course that helps people claim every right off they are entitled to as a home-based business. These strategies are golden. This will help everyone find their tax deductions more effectively." – DARLENE LONG (CANADA) |

"I found it easy to implement my numbers right along with the course. This was very educational for me. I will have better detailed record keeping to be audit proof and learned more about writing off home expenses!" – VERONICA JORDAN (USA) |

"I was never trained on what I could totally claim as expenses before this. It was easy to understand. I found the spreadsheets very helpful. It (tax season) will be a much smoother, less stressful process." – DEB MARSH (USA) |

"It (the course) was very clear and well organized. This coming year will be less stressful, much better organization and have a better impact on my return." – ENZO DIGIOVANNI (CANADA) |

"I would recommend Doug to anyone who needs extra help and support with their taxes. He really walked me through the whole process and I saved more than $2000 on taxes." – JACKIE LEE (CANADA) |

These are everyday entrepreneurs who used the system to simplify their taxes and save thousands.

Join the Home Business Tax Secrets Community

100% Tax Deductible | Cancel Anytime

When you join, you’ll finally feel organized, confident, and in control of your business finances. You’ll know exactly what to claim, how to track it, and how to prepare for tax season without stress.

What's Included:

- Complete Tax Write-Offs Made Simple Course so you understand what to claim and how to stay compliant

- Interactive Course Workbook with checklists and examples that make taxes easy to follow

- Audit-Proof Financial Templates that help you track expenses and stay organized

- 24/7 Access to a Private Member Community where you can ask questions anytime

- Direct Access via Email and Text Support for personal guidance when you need it

- Live seasonal Tax Clinics with live Q&A and step-by-step help

- Exclusive downloadable Guides covering bookkeeping, tax preparation, and audit readiness

Instant Access | Cancel Anytime

My Journey to Creating Home Business Tax Secrets

A simple idea that started to help my own home-based business now helps entrepreneurs across North America feel confident about their taxes.

After decades of running my own home-based businesses, I kept seeing the same problem repeat itself. Entrepreneurs like me were paying too much tax simply because no one ever explained how tax write-offs really work.

I decided to change that. What started as my own personal system to stay organized and save more money has grown into the Home Business Tax Secrets Community platform. It’s built for entrepreneurs who want clarity without jargon, confidence without relying completely on an accountant, and real savings they can see year after year.

Today, this system and community help home-based entrepreneurs stay organized, compliant, and confident all year long.

Still Have Questions?

You’re not alone. Most members had the same questions before joining. Once inside, they quickly realized how much easier it is to stay organized, save more, and feel confident all year long.