This Bestseller Book Was Written During the Pandemic: Home Business Tax Write-Offs

Jul 08, 2022

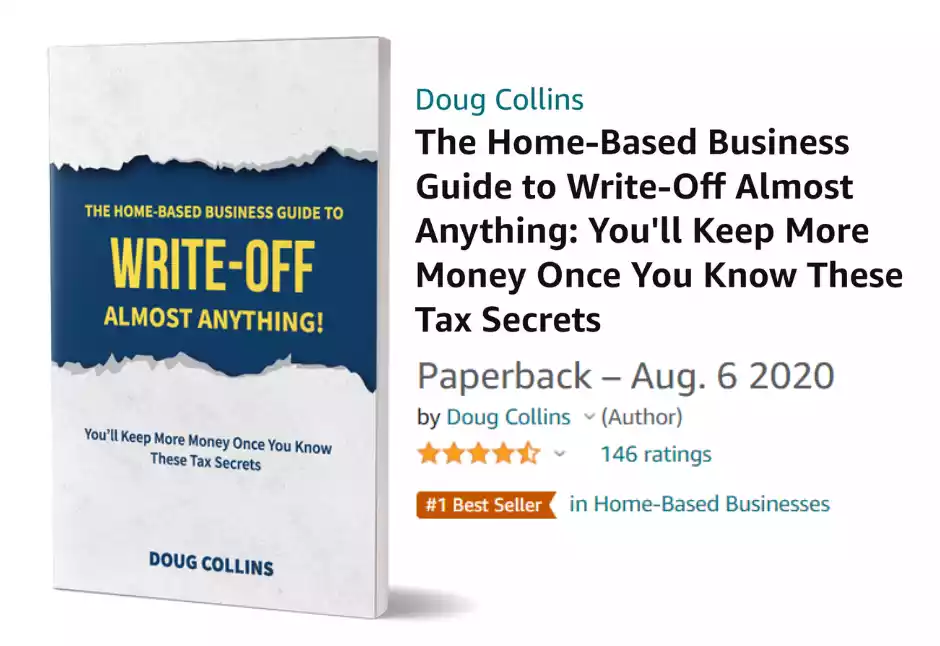

In March 2020, while home on lockdown during the pandemic, I wrote a book called “The Home-Based Business Guide To Write-Off Almost Anything!” The book was released in August of 2020 and has continued to be a #1 bestseller on Amazon.

I'm not an accountant and I do not offer tax preparation or bookkeeping services. I came up with this idea of writing book on this subject because I'm passionate about it. I just have 20 years' experience and real world in the trench's knowledge.

I poured my heart and soul into finishing a book that I felt would empower sole proprietors. I wanted to use this as a tool to help anyone in a home-based business who finds taxes scary, confusing, stressful and overwhelming.

Finally, after 5 months of long days it was published. I was proud of the finished product. I was excited and passionate to share the message inside the book. I felt confident that it would resonate with home-based freelancers, contractors, coaches, course creators, affiliate marketers, direct sales and network marketers, real estate investors and other gig economy workers across North America.

The book is a guide, it's not a "how to file taxes: book. I wrote it specific enough to give the reader value but also generic enough that it would be compliant with CRA in Canada (Revenue Canada) and the IRS in the US (Internal Revenue Service).

Canada and US Tax Systems are Very Similar

The biggest difference between the IRS and CRA is in how they calculate income taxes and the forms being used. The main difference is for those in higher tax brackets. Canadians in the higher tax brackets are taxed higher than Americans. This means the high-earning individuals in Canada pay a higher tax than the same income earners in the US. Sorry Canada!

The big difference is in the language used specific to forms, which often throws people off. Here are a few examples:

- Employment Income Statement: W2 = T4

- Personal Tax Return: 1040 = T1

- Statement of Business Profit/Loss: Schedule C = T2125

- Business Use of Home: 8829 = Part 7 on T2125

Now more than a year later, the book has become a movement continuing to stay on the Amazon bestseller rankings. I have been so blessed with all the reader reviews, feedback and stories of how this book has changed perspectives when it comes to home-based business tax write-offs.

In case you are wondering, here is the TABLE OF CONTENTS in the book:

Chapter 1: Tax Benefits of a Home-Based Business

Chapter 2: Definition of “Home-Based Business”

Chapter 3: Tax Season is Designed to Pay More Tax

Chapter 4: Your Tax Preparer is Giving You Bad Advice

Chapter 5: Take Responsibility for Your Tax Write-Offs

Chapter 6: Tax Write-Offs with No Business Income

Chapter 7: How (Why) to Show Intent to Make a Profit

Chapter 8: Tax Write-Offs as a Part-Time Business

Chapter 9: Tax Deferral Investments vs Tax Write-Offs

Chapter 10: What You Should Do with Your Tax Refund

Chapter 11: Business Use of Home Expenses

Chapter 12: Home Office Supplies

Chapter 13: Your Personal Vehicle is a Business Expense

Chapter 14: Meals & Entertainment for Business

Chapter 15: Travel & Education

Chapter 16: Marketing & Advertising

Chapter 17: Manage Your Inventory

Chapter 18: Other Expenses

Chapter 19: Calculating Your Tax Savings Potential

Chapter 20: Pulling It All Together

Say Goodbye to Tax Stress

Proven Tax Strategies, Audit-Proof Tools, and Year-Round Support for Home-Based Entrepreneurs