What’s Inside the Tax Write-Offs Made Simple System

I created this system after realizing how many home business owners—myself included—missed thousands in write-offs just because no one explained the rules.

Here’s a look at everything you’ll get inside—so even the most overwhelmed home-based entrepreneur can finally feel clear and confident.

✓ 10-Module Core Course – Step-by-Step Training

Get instant access to focused video lessons that simplify the most effective write-off strategies for home-based entrepreneurs—so you can save more and file with confidence.

Course Includes:

- Welcome and Course Downloads

- Home Business Tax Fundamentals

- Record Keeping & Being Audit Proof

- Home Office & Operating Expenses

- Vehicle Expenses & Business Mileage

- Meals & Entertainment Expenses

- Business Travel & Education

- Marketing & Advertising

- Inventory for Tax Purposes

- Plus 16 Bonus Videos

Available on desktop and mobile—learn at your own pace, anytime.

✓ Comprehensive Course Workbook

Your step-by-step companion to the course videos, packed with:

- Guided checklists

- Practical examples

- Write-off planning worksheets

- Built-in action items to help you stay organized and audit-ready

Instant PDF download and available for purchase as a coil-bound color printed workbook ($39).

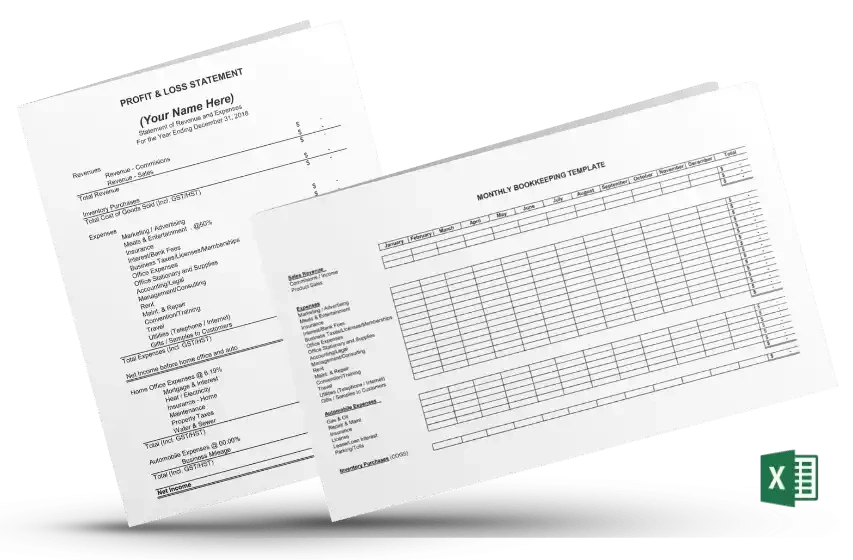

✓ Business Excellence Templates

Built-in Excel templates to help you:

- Track monthly income and expenses

- Prepare a Profit & Loss statement

- Record receipts and keep digital audit trails

These are demonstrated in the course, so you’ll know exactly how to use them.

Why Home-Based Entrepreneurs Trust This Course to Save Thousands and Stay Audit-Proof

Real People. Real Savings. Real Confidence.

Here’s what real users are saying…

“Doug, you have a way of simplifying things that makes it easy for me to understand—and that’s why I trust you.” – Alysa, Home-Based Entrepreneur

Alysa saved over $6,000 in her first year, and her husband saved another $20,000 using the same system. You can too.

Over the past decade, I’ve helped thousands of home-based entrepreneurs, direct sellers, network marketers, and solo business owners claim more and save big—with average savings of $5,500 per year.

Get the Course with Your Membership—No Extra Charge

Includes full access to the course + all tools, support, and updates

Only $47 USD/Month or $57 CAD/Month

Home Business Tax Secrets Community Membership

ONLY $47 USD/Month

or $57 CAD/Month

What's Included:

- Tax Write Offs Made Simple Course

- Course Workbook to Apply Strategies with Ease

- Audit-Proof Templates, Trackers & Tools

- 24/7 Access to a Supportive Member Community

- Monthly Office Hours (Live) – Drop In and Ask Me Anything (Live + Unrecorded)

- Seasonal Tax Clinics (Dec–April) – Monthly Filing Support & Live Q&A

- Exclusive Guides on Tax Strategies & Business Growth

- Exclusive Guides on Bookkeeping, Tax Preparation, Tax Forms and more.

Instant Access to Everything | No Long Term Commitment | Cancel Anytime