I Filed 1,200 Tax Returns as a Volunteer—Then Closed My Clinic. Here’s Why

May 25, 2025

It Started as Seasonal Volunteering—Then I Became a One-Person Year-Round CVITP Virtual Tax Clinic

Most people think of the Community Volunteer Income Tax Program (CVITP) as something that pops up during tax season and disappears after April.

When I first got involved back in 2020, I thought the same.

I started as a CVITP volunteer at a local, seasonal tax clinic—just a simple way to give back to the community by helping people file their returns.

Then the pandemic hit.

In March 2020, COVID lockdowns shut down physical tax clinics overnight—but it was still tax season, and people still needed help. For the first time, CRA allowed virtual filing. We adapted quickly. Those who had in-person appointments were contacted by phone, and their taxes were filed remotely.

That’s when everything shifted for me.

When One Volunteer Became the Easiest Way to Get Taxes Filed

The following year, the phone started ringing again. People I had helped the year before were calling back. Some referred friends or family. Word spread quickly—not just because I had helped, but because I had made it simple.

No waiting in lines.

No clinic appointments.

No paperwork confusion.

Just a phone call, a few questions, and their taxes were done.

I wasn’t faster because I had more resources—I had none.

I was just available. And that made all the difference.

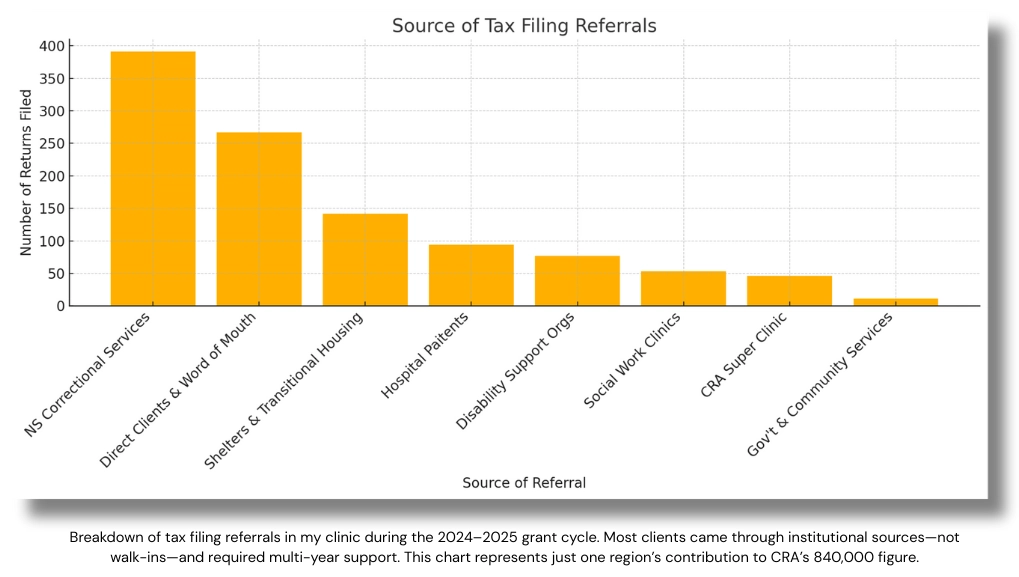

What started as a seasonal effort soon grew into something much larger. The calls and emails kept coming. Referrals flowed from hospitals, halfway houses, youth programs, and Correctional Services. And these weren’t routine filings—they were often multi-year returns tied to someone’s ability to access housing, medical care, or even basic income support.

I never set out to build something like this.

It didn’t start as too much. I just kept saying yes—because the need kept showing up.

Eventually, it became clear: I wasn’t just an option. I had become their solution.

And over time, that role became a weight I couldn’t carry alone.

What I came to understand was this: My story seemed like an outlier in the CVITP program—but it was actually a symptom of a much larger shift I never saw coming.

The Human Cost of a System Held Together by Volunteers

There’s an assumption that volunteers can just say no. And technically, that’s true.

But when someone reaches out and says getting out of their situation depends on a tax return...

When a hospital calls because a patient can’t access care without filing...

When a homeless shelter sends a request for someone who’s just got off the street and trying to get into temporary housing...

Saying no isn’t as simple as it sounds.

In many cases, I was the person they could reach. And over time, that became the norm. I was the solution.

When a Volunteer Becomes the Solution, the System Stops Looking for One

I’m proud of what I contributed. But realistically, what I was doing wasn’t sustainable.

Not for one person.

Not at this scale.

And not without support.

My filing volume wasn’t something to celebrate.

It was a reflection of a system that quietly shifted its unmet needs onto the people most willing to absorb them.

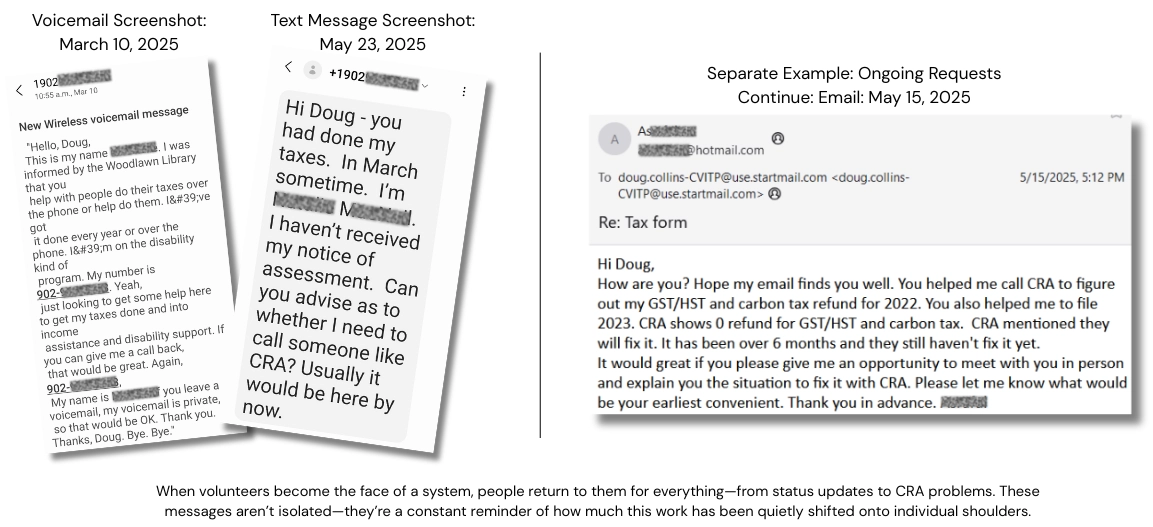

For 12 months a year, I received texts, emails, and voicemails asking for help. It was constant—an unending stream of micro-demands that never let up.

I didn’t have staff. I didn’t have a team of volunteers.

There was no administrative buffer—no one to screen calls, reply to messages, or manage scheduling.

And once tax season began, there was rarely a pause. Every single day brought new requests.

But the need didn’t follow a calendar. It didn’t peak in March and taper off in April.

It just kept coming—through every month, every season.

And while the outcomes were visible—the refunds, the benefits, the returned stability—what wasn’t visible was the toll it took to keep up. Late-night filings just to stay ahead.

Multiple daily requests from institutions like Correctional Services—each one asking for ten years of back returns, often for multiple individuals.

Weekends spent trying to catch up before Monday brought a new wave of urgent referrals.

I didn’t step away because the requests became too difficult.

I stepped away because the system kept leaning harder—assuming I’d always say yes.

But at some point, I had to recognize the truth: If I didn’t set a boundary, no one else was going to set it for me.

When Personal Access Becomes the Face of a Broken System

Here’s just two examples among many.

On March 10, 2025, I received a voicemail from someone who had been referred to me by a local library. Their clinic appointments had filled within hours, and rather than turning people away, staff began giving out my name and number. That’s when the calls started flooding in—20 to 30 per day.

I asked the library to stop referring people. I was already over capacity—managing hundreds of tax filings, voicemails, and texts on my own.

I did help the caller file their tax return. But two months later, they texted me again—asking for her Notice of Assessment. Because to them, I wasn’t just a volunteer in the system—I was the system.

This is what happens when personal access replaces structural accountability.

In other example, this individual is emailing me a year later, and after failing to get things resolved with CRA directly themselves. This is an all too common request.

If they had filed through a traditional CVITP tax clinic—like the one at the public library—they wouldn’t be calling back to speak to a specific volunteer. In most cases, they wouldn’t even know who had filed their return. But because I was accessible—and they had my phone number—I became the fallback, instead of CRA.

These are the kinds of interactions that quietly add up behind every long day of filing returns.

The late-night emails. The weekend texts. The constant expectation that one person will pick up where the system left off.

Eventually, I had to decide: it was time to shut this service down.

Who I Served—and Why Seasonal Tax Clinics Aren’t Enough

The people who came to me weren’t just looking for tax help. They were trying to access something deeper—stability, support, and survival. And more often than not, the system wasn’t built to meet them where they were.

And over time, I wasn’t just helping individuals. Institutions began referring directly—hospitals, shelters, youth programs, and Correctional Services. Not because I promoted myself. But because I answered the phone, didn’t require appointments, and could file virtually. That accessibility made me different. It made me the default.

Here’s who I served in the communities across Nova Scotia:

-

Seniors filing to maintain access to Old Age Security, pensions, or prescription coverage—or trying to restore benefits after years of missed filings

-

Individuals experiencing homelessness, needing proof of income to qualify for housing, food programs, or income assistance

-

Newcomers unfamiliar with the Canadian tax system, often supporting families while trying to access GST credits or child benefits

-

Patients in hospitals who couldn’t access provincial healthcare services and medications without up-to-date filings

-

People incarcerated or recently released—filing taxes to qualify for income assistance and simply reconnect with society

-

Youth aging out of care, who had no tax guidance, no mailing address, and no support in navigating the CRA

-

Low-income individuals who returned annually—not because they were in crisis, but because filing was their only way to stay connected to essential benefits like GST credits, carbon rebates, and social assistance

These weren’t rare cases. They became my daily norm.

This wasn’t seasonal work. It was steady, year-round support. Because in today’s Canada, filing taxes isn’t just about compliance—it’s about access to provincially funded, income-tested services.

And when the system changes its requirements to meet its own needs, the pressure doesn’t go away—it shifts to the people most willing to absorb it.

In May 2025—within the first two weeks after tax season “ended”—I filed 128 tax years for just 43 individuals. The requests weren’t slowing down.

Over the full tax reporting cycle, I filed more than 1,200 returns for over 700 people—most of them disconnected from the systems they needed to survive.

And every one of those returns unlocked something bigger than just $500,000 in tax refunds and $1.5 million in benefits—it opened the door to housing, healthcare, and stability.

Yet despite that impact, the CRA’s CVITP program still doesn’t reflect the reality I see every day in the community.

CRA Celebrated 840,000 Returns Through CVITP—But That’s Only Part of the Story

Shortly after tax season ended, the CRA shared a celebratory post on LinkedIn: 840,000 returns filed through free CVITP tax clinics.

On the surface, it sounded like a win. And in one sense, it was. That figure represents how many Canadians rely on these CVITP clinics to access critical refunds, benefits, and support.

But here’s the part that was missing: That number only reflects what was filed during tax season.

It doesn’t account for the year-round need.

It doesn’t include the people I was still filing for in May, June, July, and beyond.

It doesn’t show how many requests kept coming after the clinics shut down.

For those of us doing the work on the ground, that number tells a deeper story—one that rarely makes it into the public conversation.

Because it’s not just about volume. It’s about who those returns were for, how complex they were, and what it actually took to get them filed.

You’ve already seen what that looked like in my clinic:

-

Year-round referrals

-

Institutional reliance

-

Multi-year returns tied to housing, healthcare, and income support

-

Real-world outcomes unlocked by every filing

So yes—840,000 is a big number.

But if that figure is going to be celebrated, then the volunteers behind it—and the people they served—deserve to be recognized too.

Especially the ones still filing, long after the season ends.

The Demand Is Year-Round—But CVITP Clinics Are Still Seasonal

CRA has long framed CVITP as a tax-season program.

That framing has shaped everything—from how clinics are organized to how volunteers are recruited and supported.

But the ground-level reality has shifted.

In my case, the work never stopped. I filed returns twelve months of the year. Referrals came month after month, year after year.

Even CRA’s Recent Email Confirms the Shift

Shortly after tax season ended, CRA sent out a message to CVITP clinics asking: Would you be willing to operate year-round?

No context. No explanation. Just: "We continue to receive requests for help, even though tax season has ended."

For many, it may have felt like a routine follow-up.

But for those of us who’ve been doing this work for years, the message was clear:

The demand is no longer seasonal—but the way clinics are structured still is.

Why CRAs $5 Per Return Grant Funding Isn’t Sustainable

The CVITP grant program was introduced a few years ago as a pilot—renewed annually, with no long-term commitment and little clarity on what to expect from one year to the next.

That uncertainty wasn’t new.

But what happened on February 24, 2025—the first day of tax season—was different.

CRA’s Quiet Change to CVITP Grant Funding

CRA quietly announced a new funding formula via a general email.

No webinar. No consultation. No real explanation.

When I questioned the change the response I received was: CRA had a 30% budget cut including the grant program.

The message was simple: going forward, clinics would receive $5 per return filed.

Technically, the grant period began on June 1, 2024. But this change wasn’t communicated until February 24, 2025—when clinics were already deep into the season.

And those of us operating year-round had already done eight months of work on the premise of last years grant funding formula.

By then, it was too late for most to meaningfully adjust.

And the model itself? It made no distinction between effort, complexity, or outcome.

Filing a single-year return? $5.

Filing ten years for someone trying to regain access to housing or medical care? Still $5 each—but only for returns from 2020 onward. Unless a request for special consideration is made.

This chart shows the number of returns filed by tax years over over the last reporting season.

Whether a return unlocked thousands in missed refunds and credits—or simply updated a mailing address so CRA could reach someone for collections—it was all treated the same.

The shift made one thing clear: The program wasn’t funding outcomes. It was funding volume.

And even then, the funding didn’t go to the person doing the work.

It went to the host clinic organization.

In my case, I was both the volunteer and the clinic.

So I saw the flaw directly: this model quietly penalized small, community-based clinics—while rewarding a handful of high-volume operations.

That’s not a sustainable strategy. It’s a short-term decision that ignores long-term consequences.

And unfortunately, it wasn’t the only shift. Around the same time, CRA expanding another initiative—one that assumed automation could replace human support.

Why SimpleFile Doesn’t Replace Human Support

At the same time CRA reduced funding for community tax clinics, it quietly expanded its SimpleFile initiative in late February 2025—a fully automated filing system promoted as a low-effort alternative for many of the same people the CVITP is meant to support.

But in practice, most of the people I helped couldn’t use SimpleFile.

Their mailing addresses on file were outdated.

They didn’t have CRA MyAccount access.

Some didn’t even know which tax years were outstanding.

Others faced digital literacy barriers, lacked access to a working phone, or were dealing with trauma and mental health challenges that made self-navigation impossible.

Either CRA knows this—or the decision-makers in Ottawa are so far removed from reality that they don’t see how these policies impact vulnerable populations.

And yet, the trend continues: seasonal clinics, fewer volunteers, cuts to regional CVITP staffing, and a growing push toward automation.

Is CRA Quietly Shifting Away from CVITP?

SimpleFile has been positioned as an alternative to CVITP—but for many of the people I served, it was never a real option.

Even those who were mailed a SimpleFile invitation often came to me for help because they couldn’t navigate the process alone—or the invitation went to an outdated address.

And when you combine this automation push with:

- the $5-per-return funding model

- the elimination of regional CVITP staff

- and the lack of clear communication around these changes...

…it begins to look less like a supplement to CVITP—and more like a slow replacement of it.

If that trend continues, the result is clear: Seniors, low-income Canadians, newcomers, and people without stable housing will be left behind.

That’s why I documented what I was seeing on the ground—and brought it forward.

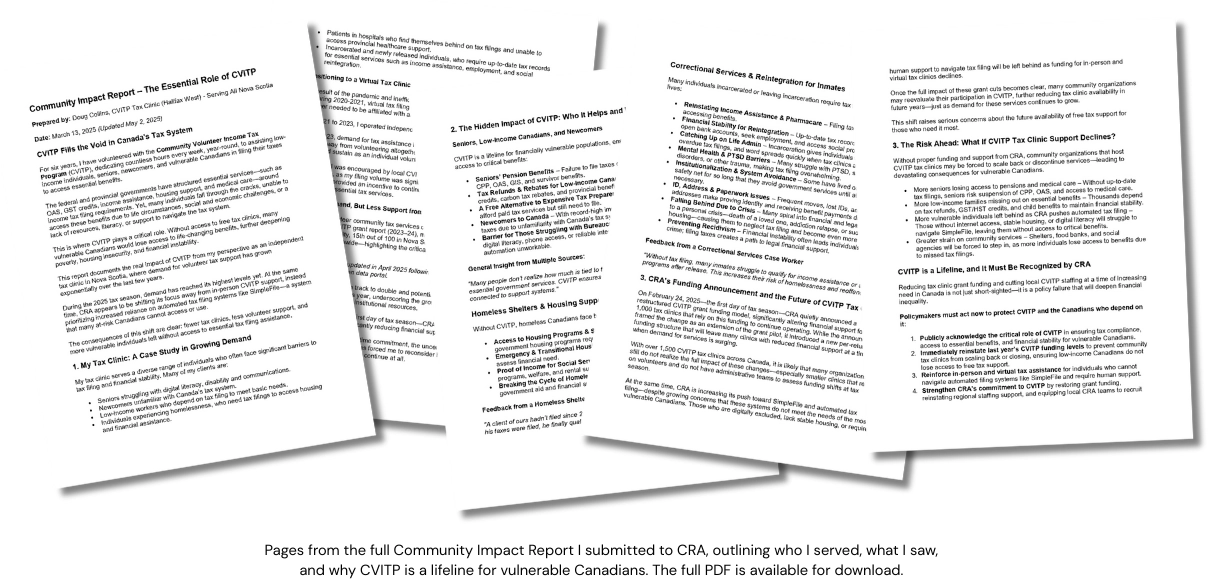

Raising the Alarm: Letters and the Community Impact Report

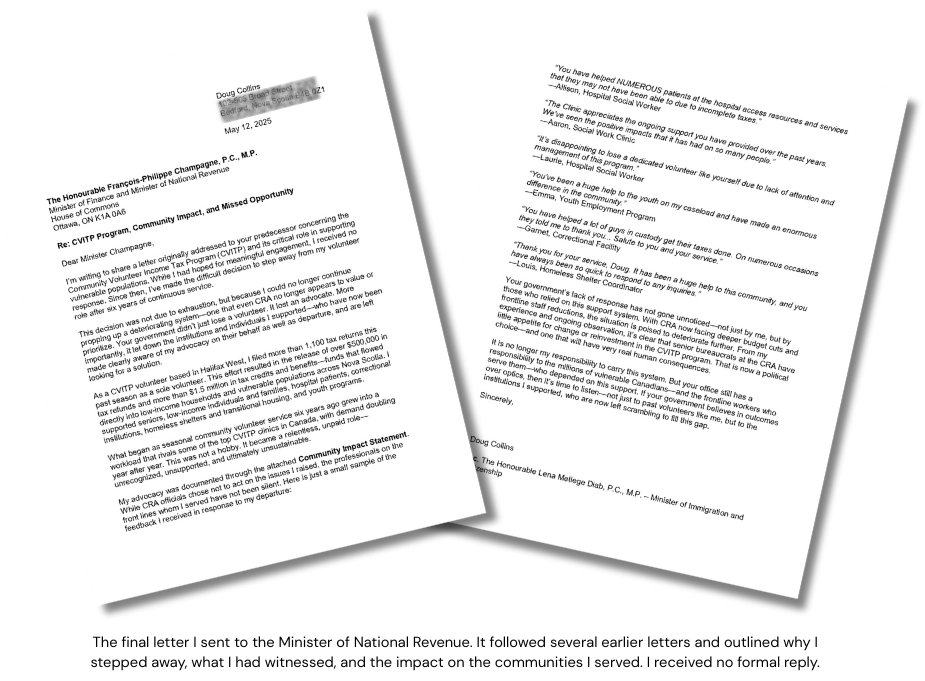

Despite sending formal letters and a detailed report to CRA, the Minister of National Revenue, and my local MP, I received no meaningful response.

In those communications, I raised three core concerns:

- The unsustainable nature of the CVITP funding model

- The systemic gaps that volunteer clinics are being asked to absorb

- The growing risk of replacing human support with automation—especially for those who cannot navigate CRA’s systems on their own

To document the full picture, I also prepared a Community Impact Report, outlining:

- Who I served

- What those tax returns unlocked

- And what it would mean if this support disappeared

These weren’t casual observations. They were grounded in thousands of real cases, drawn from six years of frontline work—including data, outcomes, and policy recommendations submitted directly to CRA and the Minister of National Revenue.

And yet, the silence that followed said as much as any policy decision. The only official reply I received was a templated response that ignored the questions raised, made no mention of the Community Impact Report, and offered no clarity on funding cuts or the shift toward automation.

It didn’t just reflect a lack of answers—it confirmed the very disconnect I was trying to address.

These documents are now available for public review—including the original letters, grant data, Community Impact Report, and CRA’s official responses.

If you’d like to read them for yourself, you can access them here on my Google Drive: Download the Community Impact Report and Letters

Because this wasn’t just about policy. It was about people. And someone had to speak up.

Why I Stepped Away—And What It Signals

I didn’t walk away because the work was too hard.

I didn’t leave because the need went away.

The truth is, the volume wasn’t sustainable. The model wasn’t scalable.

I walked away because I had already raised these concerns—through data, reports, and direct communication—and no one listened.

And the silence made it clear: the system would keep leaning harder as long as I kept saying yes.

This wasn’t a reaction. It was a responsible, measured decision—based on showing up, tracking outcomes, and advocating for change in a system that showed no signs of adapting.

I gave notice. I wrapped up the work. And I ensured every partner I worked with had time to prepare.

If you’d like to read the full picture for yourself, you can download the documents here.

- Letters to the Minister of National Revenue

- Grant data and return volume

- A full Community Impact Report

This is a case study in what’s broken.

It’s what happens when the system stops listening.

A reflection of a deeper problem—one where a volunteer model is left to quietly absorb what no one else will, in a society that needs it more than ever.

If the CVITP program is going to survive, it needs more than a checkbox asking if clinics can operate year-round.

It needs real support.

Intentional structure.

Sustainable funding.

And a commitment to both the people it claims to serve—and the people doing the work to make that happen.

What Comes Next: Empowering Home-Based Entrepreneurs Through Tax Strategy

While I’ve stepped away from volunteer tax filing, I haven’t stepped away from service. If anything, I’ve stepped into it more deliberately—focused on helping home-based entrepreneurs across North America navigate a system that was never designed to support them.

What I saw inside the CVITP program reaffirmed my original focus. Long before I was filing over 1,200 tax returns a year, I was helping home-based entrepreneurs build tax confidence. That mission never disappeared—but it did take a backseat to the growing demands of volunteer work. Now, I’m bringing it back to the forefront.

Going forward, I’ll be focused on helping home-based entrepreneurs:

- Know exactly what they can write off—and what might trigger an audit

- Organize their receipts and finances without needing to become a bookkeeper

- Stop overpaying income tax just because they’re afraid of doing something wrong

Instead of waiting for people to hit a wall, I want to meet them earlier—when the receipts are still in a shoebox, the bookkeeping hasn’t started, and the doubt is creeping in. That’s usually when the real questions show up: “What if I mess this up and get audited?” or “I think I can write this off… but what if I can’t?”.

If there’s one thing this experience made clear, it’s this: You can’t fix a broken system by burning yourself out inside it. But you can build something better alongside it.

Because with the right support, people don’t have to feel intimidated by taxes. They can feel organized, confident, and empowered to run their home business with clarity and peace of mind.

Going forward, I’m putting more energy into:

- Writing and education

- Sharing insights on social media and through my community membership

- Breaking down the ideas inside my Amazon bestseller, The Home-Based Business Guide to Write Off Almost Anything, so entrepreneurs can take action—even if they haven’t read it yet.

- And finishing the next book that’s been on hold while I kept pace with volunteer demands

It’s still about service—just built around a model that’s scalable, sustainable, and proactive instead of reactive.

P.S. If you’re a home-based entrepreneur—or just someone who wants to follow this new chapter—I’d love to stay connected. You can connect with on LinkedIn or subscribe to my monthly newsletter for early access to new content, tools, and behind-the-scenes updates. There’s more to come.

From Tax Confusion to Confidence for Home-Based Business Owners

Get expert tax guidance, tools, and support built for home-based business owners who want to stop guessing, claim every write-off, and stay audit-ready all year.

Inside the Home Business Tax Secrets Community, you’ll find proven tax strategies, practical templates, and real answers to the questions most accountants never take time to explain. You’ll finally feel organized, confident, and in control of your business finances.