Audit-Proofing Tips for Home-Based Entrepreneurs: Avoid Red Flags and Costly Mistakes

Jun 09, 2025

Are You Audit-Proof? Most Home-Based Entrepreneurs Aren’t—And Don’t Even Know It

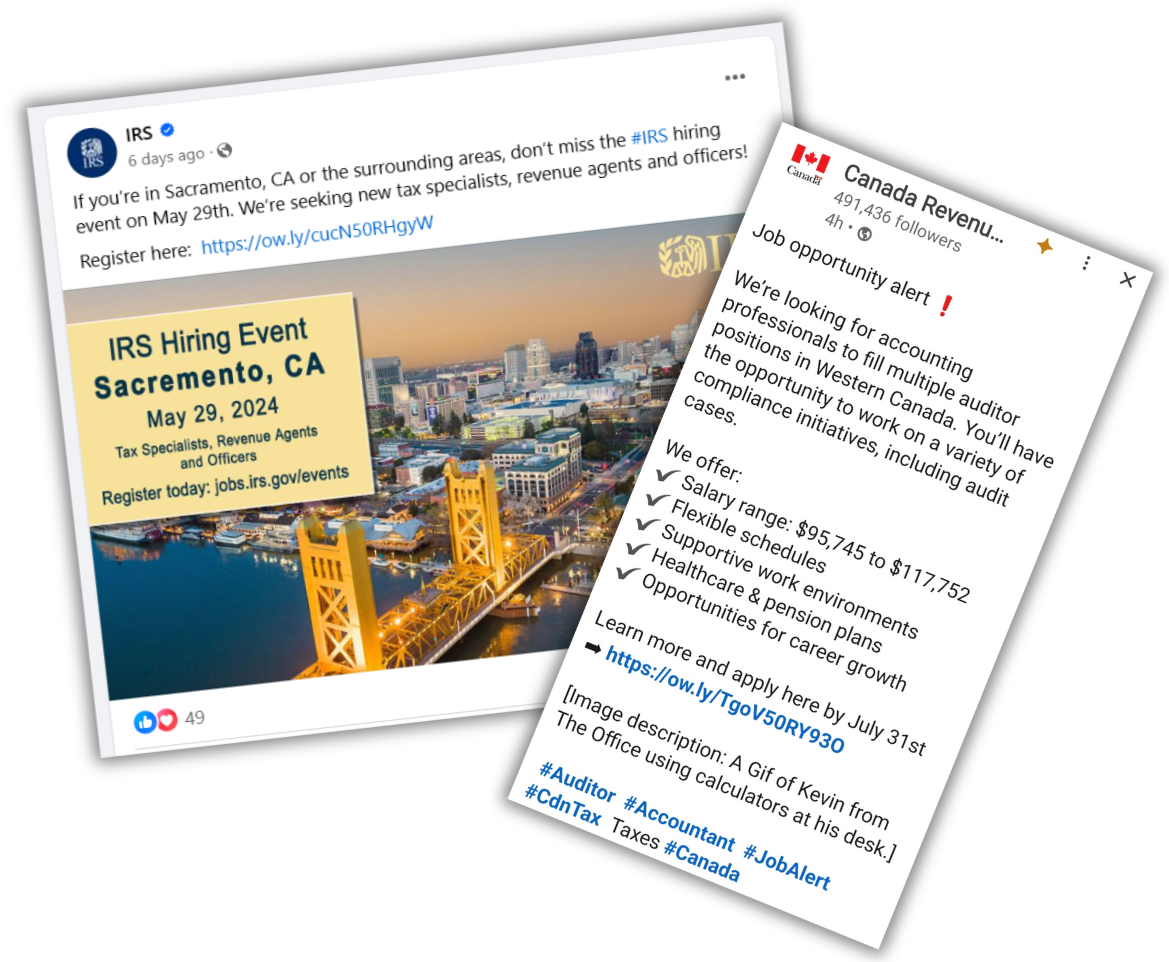

Running a business from home gives you freedom—but it also puts you on the radar. With the CRA and IRS hiring thousands of new auditors, tax authorities are turning their attention to entrepreneurs who work from home, claim business expenses, and file their own returns.

Here’s the truth: it’s not the size of your business that gets you audited—it’s the red flags you didn’t know you triggered. From misreported income and home office claims to unlogged mileage and meals, even one overlooked detail can cost you thousands.

If you're worried you’re missing something, you’re not alone—and this article is for you. You'll discover:

- The most common audit triggers flagged by the CRA and IRS

- Real examples of costly mistakes (and how to avoid them)

- The three expense categories auditors are watching most

- What a real tax auditor told me every entrepreneur should know

- And how to protect your business with better records, receipts, and strategy

You don’t need a $300/hour accountant or tax lawyer to stay compliant—you need the right information, clear support, and simple tools to back up your claims.

Let’s walk through what it really takes to be audit-proof.

Why Home-Based Entrepreneurs Fear Audits—And What You Can Do About It

Many home-based entrepreneurs feel overwhelmed by tax compliance and the fear of making costly mistakes—often leading them to take a more conservative approach when claiming tax write-offs.

However, it’s important to know that the likelihood of being audited is relatively low—unless you trigger a red flag or make a glaring error in your tax filing.

Still, understanding what triggers an audit or review, and knowing how to prepare for one, is crucial for home-based entrepreneurs. We’ll cover all of this in this newsletter.

By understanding these red flags and audit triggers, you can further reduce your chances of being audited and ensure you’re compliant with Canada Revenue Agency (CRA) and Internal Revenue Service (IRS) guidelines.

Even if you do find yourself facing an audit, it doesn’t necessarily suggest fraud or wrongdoing on your part—often, it’s just a routine procedure to verify the accuracy of your tax return or part of the tax authority's process to ensure the integrity of the taxation system.

By equipping yourself with the right knowledge and strategies, you can significantly reduce your chances of being audited and feel confident in your compliance with CRA and IRS guidelines.

Remember, knowledge is your most powerful tool in overcoming tax-related fears. Don’t simply pass this responsibility to a tax preparer—take control of this critical aspect of your business.

Common Errors That Trigger Audits

Tax audits often start with simple, avoidable errors on tax returns—errors that can cost you thousands if you’re not careful.

For many home-based entrepreneurs, the fear of making a mistake is a significant source of anxiety. Here are the most common errors I’ve seen:

-

Inaccurate or Misreported Information

Always double-check that the amounts you report are correct, and that they were entered in the right category on your tax return. -

Math Mistakes on Tax Returns

Even a small addition error can flag your return for further scrutiny. These mistakes are easy to make but even easier to avoid with careful attention. -

Bad Advice from Tax Preparers

Relying solely on a tax preparer who doesn’t fully understand your business or the basics of your tax situation can lead to costly mistakes. Remember, you are ultimately responsible for what’s on your tax return, not your tax preparer. -

Missing Receipts or Supporting Documents

Failing to keep receipts and detailed records to support your deductions can lead to a poor audit outcome for you. Ensure you have all necessary documentation organized and accessible to validate your claims.

Avoiding these common errors is the first step in audit-proofing your tax return, but it's equally important to be aware of the specific factors that can trigger an audit in the first place.

Let’s explore the top 11 audit triggers that you need to watch out for.

The Top 11 Audit Triggers for Home-Based Businesses

The prospect of being selected for a tax audit can feel like winning the worst kind of lottery.

Tax authorities like the IRS and CRA are increasingly using data analytics to identify potential audit targets. With the IRS planning to hire 20,000 new staff and the CRA ramping up its enforcement efforts, understanding what triggers an audit is becoming even more important than ever.

Here are the top 11 audit triggers that can increase your odds of being selected:

-

Being Self-Employed Without Withheld Taxes

Without taxes withheld at the source, self-employed individuals are more likely to underreport income. -

Running a Cash Business

Cash transactions are harder to trace, making these businesses prime targets for audits. -

Claiming High Expenses or Repeat Losses

Claiming expenses significantly higher than industry standards can raise red flags. Consistent losses can lead tax authorities to question the legitimacy of your business. -

Vehicle and Home Office Red Flags

Overstating your vehicle mileage and home’s business use can lead to closer examination. -

Related Party Audits

If someone connected to you is audited, your return might also be scrutinized. -

Lifestyle Discrepancies

Reporting an income that doesn’t match your lifestyle can trigger an audit. -

Industry-Specific Risks

Certain industries, like food services or construction, are more prone to audits. -

Prior Audits

If you’ve been audited before and had claims denied, you’re at higher risk for future audits.

These triggers highlight the importance of meticulous record-keeping and understanding tax regulations.

But knowing what can trigger an audit is only half the battle. To truly safeguard your business, you need insider knowledge on how to avoid these pitfalls. Let’s dive into some expert tips straight from a tax auditor.

What a Tax Auditor Told Me: Real Insights That Could Save You Thousands

Earlier this year, I had an extensive conversation with a government tax auditor whose role is to audit small businesses, including home-based entrepreneurs.

I inquired about the most common areas they scrutinize in their audits, particularly for those claiming home-based business expenses.

The auditor mentioned that while many entrepreneurs believe they’re claiming what they’re entitled to, they often miss out because they don’t keep detailed records or fully understand what’s eligible.

This is often a result of misinformation shared among the entrepreneurial community, advice from tax preparers, or information circulated on social media.

The insights were not surprising but provided strong confirmation of what I’ve experienced for decades. This is why I decided to write the book The Home-Based Business Guide to Write Off Almost Anything—to break down the intimidating world of taxes into approachable, actionable advice.

The book was written to help home-based entrepreneurs understand the full scope of tax benefits they’re entitled to and to equip them to speak to their tax preparer with confidence.

What Most Entrepreneurs Get Wrong About Record-Keeping

The auditor stressed that, in their experience, those claiming home-based business expenses aren’t always fully aware of what they can claim. Some try to handle taxes on their own, while many rely on tax preparers who may not provide the necessary advice.

Many entrepreneurs either fail to keep detailed records or mistakenly claim these expenses without proper due diligence or guidance. These simple mistakes can easily lead to a costly audit result.

Let’s take a closer look at the three most common pitfalls this tax auditor encounters with home-based businesses: the incorrect claiming of meal expenses, vehicle mileage, and business use of home square footage.

The Three Expense Categories Auditors Scrutinize Most

One of the most common mistakes involves the incorrect claiming of meals expenses—or often, either not recorded properly, or they are claiming personal meal expenses that are not eligible.

Meals: The 5-Point Checklist You Need on Every Receipt

Did you know that for your meal expense to be recorded correctly you must have 5 things (3 of them are already on the receipt).

To ensure you stay compliant, be sure to keep records for each meal receipt by following this quick checklist:

- Name of the place

- Date of the meal/event

- Total amount spent

- Name of the person you dined with

- Business purpose or topic discussed

Keeping detailed records that include this information will help you accurately claim legitimate meal expenses and avoid unnecessary scrutiny.

Mileage Logs: The Record That Saves You at Audit Time

Vehicle expenses are a common focus for IRS and CRA auditors, especially for home-based entrepreneurs.

Tax authorities know that detailed record-keeping for vehicle expenses can be a challenging aspect of running a business, and this is often where auditors find weaknesses.

The truth is that many people estimate their total mileage for the year and business portion, and often do not keep accurate records of business trips throughout the year.

To stay compliant, you must keep a detailed log of your vehicle’s business use. Here’s how:

- Record Business Trips: Log the date, destination, reason, and mileage driven for each business trip. Don’t forget to note the odometer reading at the beginning and end of the year.

- Track Motor Vehicle Expenses: Include interest on loans, capital cost allowance, leasing costs, and operating expenses like fuel, oil, maintenance, and insurance (and yes, even car washes!).

Are you keeping a detailed record of your vehicle use throughout the year? If not, it’s time to start.

Home Office Space: Don’t Overstate Your Square Footage

The third item that the auditor shared with me was in how home-based entrepreneurs calculate their percentage of business use in the home.

I know in my experience, in the Home Business Tax Secrets Facebook Group community, this question has come up frequently over the years. I even dedicated an entire chapter to this topic in my book.

The square footage guidelines are generally similar for both the CRA and the IRS.

The CRA advises that you "use a reasonable basis" for calculating business use of home expenses, while the IRS specifies that the calculation should be based on “the percentage of the home floor space used for business.”

Avoiding Red Flags in Your Home Office Claim

What might flag an audit is claiming a very high percentage of your home as business-use space. Tax authorities know that you live there too.

For example, if you place a desk in your living room and claim the entire room as your “home office square footage” because it’s the largest room in your home, this might raise a red flag.

A tax auditor might suspect that the space is not used exclusively for business. Even if it is, you would need well-documented records to support your claim.

Qualifying Your Home Office as a Principal Place of Business

Your home office will qualify as your principal place of business if you meet the following requirements:

- You use it exclusively and regularly for administrative or management activities related to your trade or business.

- You have no other fixed location where you conduct substantial administrative or management activities for your trade or business.

By following these guidelines, you will ensure your home-based business is well-documented for tax purposes.

Understanding and Responding to a CRA or IRS Desk Audit

When it comes to audits, one of the more common types that home-based entrepreneurs might experience is a "desk audit."

During a desk audit, the assigned auditor may send a letter with specific questions regarding claims on a tax return, or they might address more comprehensive topics such as home business operations, office space, industry practices, marketing, customer interactions, vehicle usage, financial records, receipts, and both short-term and long-term business plans.

What Questions You’ll Be Asked

Each question in the desk audit questionnaire is designed to help the IRS or CRA better understand your business operations and financial situation.

When responding to the audit questionnaire, it’s crucial to read the questions carefully and provide accurate and complete information.

I wrote an article titled Avoid These Audit Triggers: Bullet-Proof Your Tax Records Before It’s Too Late written to navigate a desk audit that included an actual questionnaire that a home-based entrepreneur received.

As you read through these questions, you will begin to notice that the requests to the taxpayer are very specific, targeted, and strategically asked.

Another form of audit, which I have personally experienced, is a reassessment by tax authorities. In this scenario, they make an assessment based on the information they have and send you a letter outlining their findings and the result.

How to Answer with Confidence and Accuracy

I have written extensively about being audit-proof and the importance of record-keeping in my book and teach this through my coaching. I cannot stress enough how crucial this is!

Good record-keeping will almost always save the day, especially if you need to go back a few years. Who remembers any level of detail going back 2, 3, or 4 years?

What My $15,000 CRA Battle Taught Me About Documentation

In 2015, I was reassessed by the CRA. They sent me a letter with their decision, along with a bill for over $15,000, including taxes they claimed I owed, plus interest and penalty charges. This assessment spanned the previous three tax years.

I wrote an objection letter, but it was denied. I wrote a second objection letter, and it was denied again. I wasn’t going to pay them because I knew they were wrong in their assessment, and this dragged on for so many months.

So I reached out to a former CRA Senior Tax Collector in Toronto who specializes in these kinds of cases. He said I had almost zero chance of winning after filing two objection letters, and now, almost a year later, my chances were even slimmer. But if I sent him a $1,700 retainer, he would help me file a third objection letter.

He mentioned that the CRA almost never reverses their decisions after two objection letters, but I could always try again!

The Third Objection Letter That Changed Everything

I wasn’t going to give up and felt I could do this myself. So I spent days preparing my own third objection letter. This time, I sent my response in a box filled with copies of supporting documents, arguing against their decision point by point over the previous three years.

I received a final decision letter informing me that the entire outstanding balance was canceled and everything was reversed—they finally agreed with me and my evidence. I won!

How Documentation Helped Me Win

The lesson here is that there are no hard and fast rules when it comes to claiming tax write-offs. While some guidelines are clearly defined, others are open to interpretation.

When it comes to tax write-offs, if you feel it is justified (and legal), always ensure you have documentation to support your claim.

In the end, it was my record-keeping and detailed response, combined with my persistence to stand up for myself, that won that battle with the CRA.

On two other occasions, I received letters from the CRA for a "random verification audit," and both times I sent them an over-the-top response and never heard back!

Know Your Rights: How to Navigate an Audit with Confidence

Knowing what you can and cannot write off on your taxes is the difference between putting thousands in your pocket or just letting the government take it. Forbes says 93% of business owners overpay their taxes.

On the other hand, I have seen other home-based entrepreneurs go into these situations with very little documentation and inadequate responses to audit inquiries, which resulted in tax authorities declining their write-offs, costing them thousands.

Should you ever find yourself in an audit situation, understanding your rights as a taxpayer is important. Being aware of your rights not only empowers you but also ensures that you navigate the audit process with the respect and fairness you deserve.

Your Right to Courtesy and Confidentiality

First, you have the right to be treated with courtesy and professionalism throughout the audit. Expect respectful communication and fair treatment from the auditors. Remember, an audit is a professional procedure, not a personal indictment.

Right to Privacy and Confidentiality

Your privacy and confidentiality are also paramount. Your financial information should be handled securely, ensuring that sensitive details about your home-based business remain protected.

Your Right to Representation and Appeal

You also have the right to representation. During the audit, you can be represented by a tax professional who can provide clarity and support, ensuring your interests are well-represented. Finally, if you disagree with the outcome of the audit, you have the right to request a hearing or appeal. This gives you the opportunity to present additional information or clarification if you believe the auditor's decision is incorrect. Knowing your rights can transform the audit experience from one of apprehension to one of informed participation.

Build Confidence, Not Just Compliance

Preventing audits isn’t just about staying under the radar—it’s about securing your peace of mind and financial future. With the IRS and CRA increasing their scrutiny, your best defense is solid knowledge and meticulous record-keeping.

Take the Next Step—Start Audit-Proofing Today

Accurate record-keeping is essential for all taxpayers, but it’s especially important for home-based entrepreneurs. It helps demonstrate the legitimacy of your business expenses and income.

Download the Tax Preparation Checklist

To help you get started with gathering your receipts and information, I’ve created a Tax Preparation Checklist that you can download and print.

Empower yourself with the right tax strategies, and don’t let the fear of audits hold you back. With meticulous records, you can confidently claim all your rightful write-offs, minimize your income tax, and focus on growing your business.

Get the Book – The Home-Based Business Guide to Write Off Almost Anything

If you don’t have the book yet, you can grab your copy on Amazon and begin your journey to changing your tax-paying future forever:

Order the The Home-Based Business Guide to Write Off Almost Anything today!

Join the Community – Year-Round Audit-Proofing Support for Home Entrepreneurs

Don’t wait for a tax letter to start protecting yourself. Inside the Home Business Tax Secrets Community, you’ll get practical tools, expert guidance, and year-round support designed specifically for home-based entrepreneurs.

Whether you're managing receipts, calculating your business-use-of-home percentage, or preparing to respond to a CRA or IRS letter—you don’t have to figure it out alone.

As a member, you’ll get:

- Access to my Tax Write-Offs Made Simple System (no extra charge)

- Downloadable audit-proofing tools and checklists

- Real answers to real-world tax questions—from someone who’s done it and lived it

- A supportive space to ask questions and gain confidence in your tax strategy

Missing one deduction can cost more than a year of support. Join today and take control of your tax strategy with peace of mind.

👉 Learn more and join now at www.HomeBusinessTaxSecrets.com/membership

From Tax Confusion to Confidence for Home-Based Business Owners

Get expert tax guidance, tools, and support built for home-based business owners who want to stop guessing, claim every write-off, and stay audit-ready all year.

Inside the Home Business Tax Secrets Community, you’ll find proven tax strategies, practical templates, and real answers to the questions most accountants never take time to explain. You’ll finally feel organized, confident, and in control of your business finances.