Stop Overpaying on Taxes: Proven Write-Off Strategies for Home-Based Entrepreneurs

Jun 04, 2025

Why So Many Home Entrepreneurs Are Still Overpaying

Running a home-based business should be your path to more freedom—not more frustration. But when it comes to taxes, too many entrepreneurs are quietly overpaying year after year, often without realizing it.

They assume their accountant has it covered.

They don’t ask questions because they’re afraid of sounding uninformed.

They keep receipts “just in case” but aren’t sure what to do with them.

And when tax season hits, the panic sets in—because deep down, they know they’re probably missing something important.

This isn’t just a paperwork problem. It’s a financial leak—and for many home-based business owners, it’s draining thousands of dollars every year.

The Hidden Cost of Fear and Uncertainty

If you’ve ever hesitated to claim a tax write-off because you weren’t sure if it was allowed, you’re not alone. Fear of triggering an audit stops many home entrepreneurs from claiming deductions they’re legally entitled to.

But here’s the irony: Not knowing the rules is riskier than following them.

Fear and confusion don’t just cost you peace of mind—they cost you real money. Missed write-offs, overpaid taxes, and underreported expenses add up quickly. And unfortunately, no one taps you on the shoulder to say: “You could have claimed that.”

The CRA and IRS won’t notify you when you leave money on the table. They’ll just keep it.

Why Tax Preparers Don’t Always Help

It’s tempting to hand everything off to a tax preparer and assume you’re covered. But most tax preparers are focused on one thing: compliance. They file what you give them—but they rarely offer proactive advice on home-based business tax write-offs unless you ask.

And that’s a problem.

Because unless your preparer specializes in home-based businesses, they may not understand what counts as a legitimate deduction—or how to properly document it.

In fact, according to Forbes, 93% of business owners are still overpaying on taxes—even if they work with a high-priced accountant.

So if you’ve ever paid hundreds (or thousands) to a tax professional and still walked away feeling unsure, you’re not imagining it. Most home entrepreneurs don’t need a more expensive accountant. They need better strategy, support, and clarity.

The Real Risk of Doing Nothing

Here’s the truth most entrepreneurs don’t hear: Doing nothing is a decision.

Waiting until the end of the year to “figure it out” means you’re already behind.

Avoiding tax questions because they feel too complex leaves you vulnerable.

Relying on outdated habits like the shoebox method or last-minute scrambles means deductions will get missed—and missed write-offs are like free money you never collect.

The real risk isn’t getting audited. The real risk is never learning what’s possible.

The Tax System Feels Stacked Against You—But It Doesn’t Have to Be

If you’ve ever felt like no matter how hard you work, the government always gets the first cut, you’re not imagining it.

For home-based business owners, taxes don’t just show up in April—they show up in every transaction, every bill, every quarter. And over time, that constant pressure adds up.

The Mental Weight of Tax Season

Tax season isn’t just a filing deadline—it’s an emotional rollercoaster.

There’s the scramble to gather receipts.

The stress of not knowing what you can actually claim.

The dread of owing more than you expected.

For many entrepreneurs, tax season triggers guilt, procrastination, and a sinking feeling that something important has been missed. And it’s not because they’re lazy—it’s because they were never taught how the tax system works.

School didn’t teach it. Most accountants don’t explain it. And unless you seek out the knowledge yourself, you’re left guessing.

That mental weight is exhausting—and it gets heavier each year if nothing changes.

“Taxed to Death” Isn’t Just a Saying

We throw around phrases like “taxed to death” without really thinking about what they mean. But when you break it down, most of us are being taxed in far more ways than we realize:

- Income tax (federal, state/provincial, local)

- Sales tax on almost everything you buy

- Property tax if you own your home

- Self-employment tax on your business income

- Payroll tax if you hire help

- Carbon tax, luxury tax, sin tax... the list goes on

Add it all up and it’s not uncommon for home-based entrepreneurs to see 30–50% of their income disappear through direct and indirect taxation.

When you’re the one creating the income, driving the business, and covering your own benefits, that tax burden feels personal.

And unless you’re actively managing it, the system will keep taking more.

Understanding the Full Scope of What You Pay

The first step to reducing your tax burden is understanding where it's actually going.

Most entrepreneurs only look at what they owe in April. But the true cost of taxation shows up year-round—on utility bills, gas pumps, online sales platforms, and more.

That awareness alone can shift your mindset.

When you start to see just how much of your income is being taxed, it becomes clear why tax write-offs matter so much. Every dollar you legally deduct is a dollar that stays in your pocket—not the government’s.

And that’s not gaming the system. That’s using the system the way it was designed—for small businesses, self-employed professionals, and entrepreneurs who are willing to do the work.

Break Free from the Fear—Shift to Strategy

If fear has been your tax strategy, you’re not alone. Most entrepreneurs were never taught how to navigate the system, and even fewer were shown how to use it to their advantage.

But fear leads to avoidance—and avoidance leads to overpayment.

Shifting from fear to strategy doesn’t require perfection. It just requires a decision: to learn, to document, and to take control.

Why Most Entrepreneurs Are Operating Blind

Surveys show that a large percentage of small business owners don’t have a clear understanding of their monthly income and expenses. They know money comes in and goes out—but they couldn’t tell you their profit margin or how much they’ve spent on business tools, supplies, or travel.

Why does that matter?

Because if you don’t know what you’re spending, you’re almost certainly missing tax write-offs. And if you don’t know what to track, you’re probably not tracking the right things.

The truth is, you can’t maximize your write-offs—or protect yourself in case of an audit—without visibility. Most people are flying blind, hoping their tax preparer can “clean it up later.”

But by then, it’s usually too late.

One of the most powerful ways to reduce your tax bill is also the simplest: good recordkeeping.

Keeping accurate, categorized records throughout the year puts you in the driver’s seat. It lets you:

- Claim every legitimate write-off without second-guessing

- Justify expenses if ever questioned by the CRA or IRS

- Avoid the year-end panic of sorting through a mountain of receipts

It doesn’t need to be complicated. Whether you use an app, a spreadsheet, or pen and paper, the key is consistency.

Even five minutes a week can save you thousands come tax time.

The Problem with the “Shoebox” Method

You’ve probably heard of the “shoebox method”—tossing all your receipts in a box and handing them off at the end of the year.

Here’s the problem: shoeboxes don’t sort themselves.

This method leads to missed deductions, stress, and late-night scrambling. It also leaves you vulnerable if the tax authority ever asks for documentation. By the time you try to piece it all together, chances are high that something will be missing—or look suspiciously inconsistent.

Worse, if you rely on a tax preparer, you’re putting them in the impossible position of making sense of chaos. Most will play it safe, skip questionable write-offs, and file something “safe”—which usually means you overpay.

The fix isn’t complicated. It starts with a simple mindset shift: you don’t need to be perfect—you just need to be proactive.

We’ve Been Programmed to Fear Taxes Since Childhood

It’s no wonder taxes feel intimidating—most of us were conditioned from a young age to see them as mysterious, painful, and inevitable.

And that early programming still shapes how we think about money today.

Monopoly, School, and the Silence Around Taxes

Remember playing Monopoly as a kid?

It seemed like harmless fun—until you landed on Luxury Tax or Income Tax and had to hand over a chunk of your cash with no explanation. The message was clear: taxes are unavoidable and frustrating, and you don’t get a say in how it works.

Then we went to school. We learned trigonometry, Shakespeare, and the Pythagorean theorem—but not one class on how taxes function, what deductions mean, or how to manage money as a self-employed person.

By the time we enter adulthood, most of us are already carrying unspoken beliefs about taxes:

- “It’s too complicated.”

- “I’ll never understand it.”

- “I’ll probably mess something up.”

This silence creates confusion—and confusion leads to inaction.

How Early Programming Blocks Tax Confidence

When you’ve never been taught how the system works, it’s easy to assume everyone else knows something you don’t.

That’s especially true for home-based entrepreneurs who didn’t grow up in business or accounting circles. You’re building something from scratch—but when tax season comes around, it feels like you’re back in a test you never studied for.

Even successful business owners carry limiting beliefs like:

- “I’m bad with numbers.”

- “I just give everything to my accountant.”

- “I’m not confident enough to file on my own.”

But here’s the truth: you’re more capable than you think.

You don’t need a CPA designation or a finance degree. You just need the right tools, a few key habits, and someone who can break it down in plain language.

Why Financial Literacy Starts with Tax Literacy

Want to feel confident in your business finances? Start with your taxes.

Taxes touch every dollar you earn. They influence your pricing, your profitability, and your ability to reinvest in growth. Yet most entrepreneurs treat taxes as a once-a-year nuisance—something to “get through” instead of something to strategically manage.

But once you understand how tax write-offs work, a new kind of clarity opens up. You begin to see your business through a strategic lens. You plan ahead instead of looking back. And you stop asking, “Can I claim this?” and start asking, “How should I structure this to be deductible?”

That shift—from uncertainty to control—is the foundation of financial literacy. And it starts by unlearning what you were never taught.

Two Tax Systems—Only One Gives You Power

Most people don’t realize this, but there are really two different tax systems in North America—one for employees and one for entrepreneurs. And only one of them gives you the power to control what you pay.

Understanding the difference is one of the biggest mindset shifts you can make as a home-based business owner.

Employees vs. Entrepreneurs

If you’ve ever worked a traditional job, you already know how the employee tax system works: your employer deducts taxes before your paycheck even hits your account. You don’t decide what’s withheld. You don’t choose how it’s reported. The system is built for automation, not flexibility.

It’s designed to ensure the government gets paid first.

As an employee, there are almost no opportunities to reduce your tax burden. You get taxed on gross earnings, and any possible credits or deductions—like RRSPs in Canada or 401(k) contributions in the U.S.—are limited and tightly controlled.

The Flexibility of the Self-Employed Tax System

As a self-employed individual, you’re taxed on net income, not gross. That means you get to deduct all legitimate business expenses before the government takes its share.

That’s a massive shift in control.

If your business earns $60,000 but you have $15,000 in eligible business expenses—tools, workspace, travel, software, phone, internet, and more—you’re only taxed on the remaining $45,000.

It’s not about “cheating the system.” It’s about using the system the way it was designed for small business owners, freelancers, and home-based entrepreneurs.

But that flexibility only works if you know what to claim—and how to document it properly.

Deductions You May Be Missing

Here are just a few of the home-based business tax write-offs that employees can’t touch—but you can:

- A percentage of your rent or mortgage if you work from home

- Internet and utilities based on business use

- Your cell phone plan, if used for client calls or admin

- Office supplies, printers, and tech tools

- Travel costs related to business activities

- Meals during client meetings or business events

- Subscriptions, coaching, or software used in your business

Many entrepreneurs are shocked to learn how much of their everyday spending could qualify—if tracked and framed correctly.

Unfortunately, most don’t claim these write-offs because they were never shown how. They’re worried about red flags. They assume it’s “not worth the trouble.” Or they rely on a tax preparer who doesn’t ask the right questions.

That’s how people overpay.

But once you start applying the rules like an entrepreneur—not an employee—you begin to see just how much control you actually have.

Demystifying Home-Based Business Write-Offs

The phrase “tax write-off” can sound intimidating, but it’s actually one of the most powerful tools in your financial toolkit as a home-based entrepreneur.

The CRA and IRS both allow you to deduct legitimate business expenses from your income—but only if you understand what qualifies, and how to document it.

When you know the rules, tax write-offs become a way to legally reduce your income taxes, stay compliant, and keep more of what you earn.

What Counts as a Write-Off?

A tax write-off is simply an ordinary and necessary expense that supports your business.

That phrase—ordinary and necessary—is what the IRS and CRA both use. It means the expense must be commonly accepted in your field and helpful to the operation of your business.

For example:

- A self-published author might deduct editing software, ISBN registration, and proof copies.

- A nutrition coach might deduct Zoom fees, Canva subscription, or recipe creation tools.

- A freelancer might deduct marketing courses, email platforms, and a portion of home utilities.

The key is intent. If it’s a real business with a real purpose—and you have records to back it up—it’s likely deductible.

Everyday Expenses That Can Become Tax Savings

One of the biggest advantages of running a home-based business is that you may already be spending money on things that can be partially written off:

- Home Office: A portion of your rent or mortgage, utilities, property taxes, or maintenance costs

- Internet and Phone: Based on the percentage used for business activity

- Meals and Travel: When directly tied to income-generating activities

- Tech and Subscriptions: Apps, design tools, and cloud storage used for your business

- Office Supplies: Printer ink, paper, notebooks—even part of your furniture if your workspace qualifies

These aren’t luxury purchases or loopholes. They’re strategic uses of everyday spending—turned into tax savings through documentation and intent.

One Simple Monthly Habit That Saves Thousands

Here’s one habit I teach every client and community member: set a recurring 10-minute check-in each month to track and categorize your business expenses.

That’s it. Ten minutes. Once a month.

Use a spreadsheet, a notes app, or my downloadable tools—it doesn’t matter what system you choose, as long as you’re consistent.

Each month, jot down:

- What you spent

- Why it relates to your business

- Where the receipt is stored (paper or digital)

By tax season, you’ll have a clean, audit-ready record of your write-offs—without the stress, guessing, or shoebox scramble.

This one simple habit has saved my clients and readers thousands in overpaid taxes—and helped them feel more confident, empowered, and in control.

Tools to Help You Take Control

You don’t need to memorize the entire tax code to manage your home-based business taxes confidently. You just need the right tools—created by someone who’s walked this path and understands what actually works in the real world.

These resources were designed to help you organize your finances, maximize your write-offs, and reduce stress at tax time—without needing to rely on guesswork or generic advice.

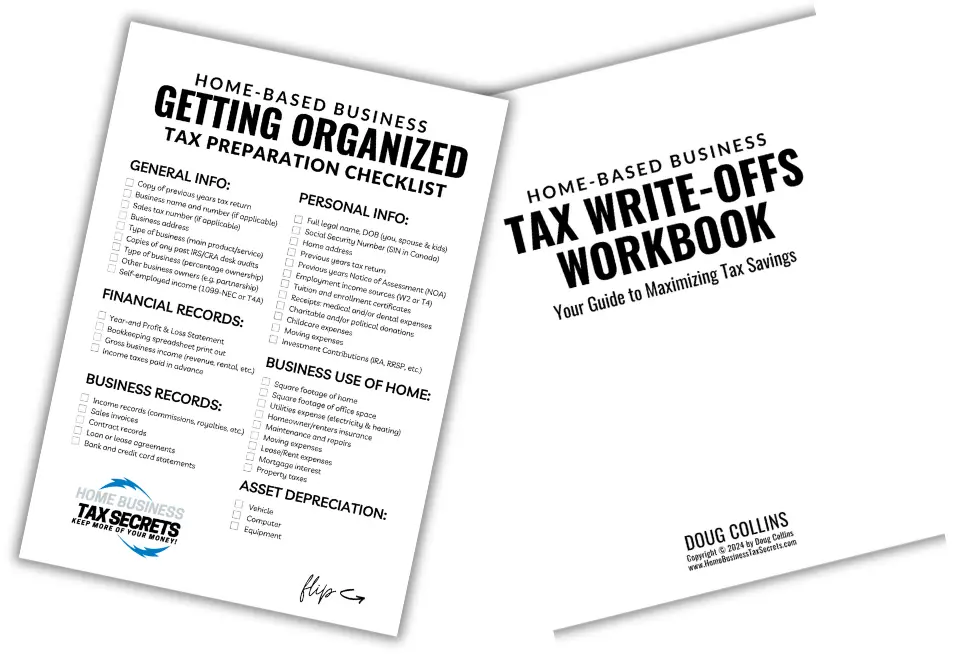

The Tax Preparation Checklist

This simple, printable Tax Preparation Checklist walks you through the exact steps I recommend every home entrepreneur take before filing their return.

Inside, you’ll find:

- What documents to gather

- Which expense categories to review

- How to prepare for both self-filing and working with a preparer

- A section to review your own monthly recordkeeping system

Whether you’re just getting started or need a better system than “hope and hustle,” this tool gives you clarity and structure in one easy download.

The Tax Write-Offs Workbook

Think of this as your hands-on companion to my book. The Tax Write-Offs Workbook helps you apply the strategies you’re learning to your actual business.

It includes:

- Guided prompts to reflect on your current tax habits

- Worksheets to track deductible expenses by category

- Real-world examples and notes from other entrepreneurs just like you

- A place to document your questions or items to follow up on with your tax preparer

This workbook isn’t about theory—it’s about implementation. Use it monthly or quarterly to stay on top of your write-offs, build an audit-ready file, and reduce the pressure that builds up each spring.

The Book That Changes Everything

If you haven’t already read it, The Home-Based Business Guide to Write Off Almost Anything is where it all begins.

I wrote this book because I was tired of watching good entrepreneurs overpay on taxes, rely on untrained preparers, or feel like they were just winging it.

Inside, you’ll learn:

- What qualifies as a business expense (and how to frame it properly)

- Why documentation matters more than dollar amount

- How to avoid common write-off mistakes that raise red flags

- What the CRA and IRS are actually looking for in a return

It’s not about loopholes. It’s about confidence. Strategy. Peace of mind.

The book, checklist, and workbook work together as a complete toolkit—whether you’re managing taxes in Canada or the U.S., filing solo or using a preparer, new to business or years in.

Real Entrepreneurs. Real Tax Savings.

You’ve heard the strategies. You’ve seen the tools.

Now let me introduce you to two entrepreneurs—one in Canada, one in the U.S.—who were once overwhelmed by taxes, just like you. They decided to take control, and the results speak for themselves.

These are real people with real businesses—and the exact kind of stories that prove it’s possible.

How Alysa in Ontario Saved $6,000

Alysa Golden, a home-based entrepreneur in Ontario, used to dread tax season.

She was disorganized. Her receipts were scattered. She didn’t know what counted as a business write-off—and every year, she felt like she was starting from scratch.

That changed when she discovered my book and enrolled in the Tax Write-Offs Made Simple System.

Here’s what else Alysa had to say:

“The information inside the course made things feel easy. The spreadsheets and systems were right there, so I didn’t have to try to create something on my own or even think about finding a system. The opportunity to have your support was a huge selling point for me. I knew you cared, and every time I reached out, you were always there.”

With a few shifts in how she tracked expenses and filed her taxes, Alysa saved almost $6,000 in her first year. But more importantly, she gained the confidence to stay organized and in control—not just during tax season, but all year long.

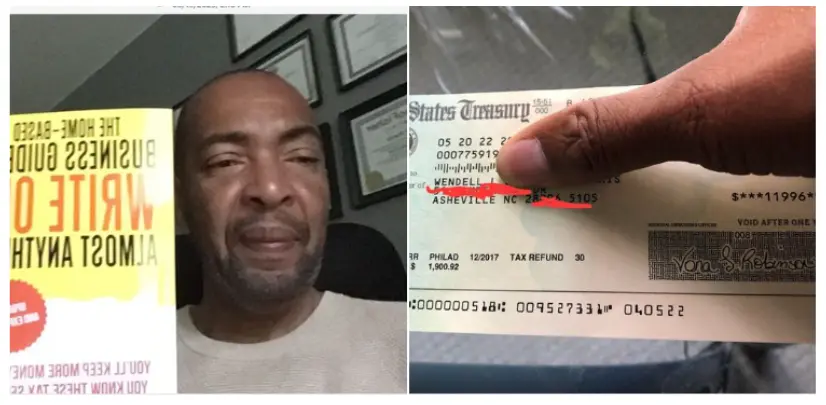

How Wendell in North Carolina Got a $30,000 Refund

Wendell’s story starts with a familiar frustration: he was paying a CPA to handle his taxes, but something still didn’t feel right.

After reading my book, Wendell reached out to ask some questions. One conversation turned into a full strategy call, where we uncovered missed opportunities buried in his past returns.

His CPA didn’t agree with what he was learning—but Wendell trusted his gut, took the lead, and filed his own amended returns.

The result?

- A $17,000 refund from the IRS within a few months

- Another $13,000 refund the following year

- Over $30,000 recovered—just by understanding his write-offs and being willing to take action

Wendell shared:

“Doug, you’ve written a great book that simplifies understanding and boosts confidence for people like me to take the next step and claim all their write-offs... No one else is offering help like you. You are doing a wonderful thing!”

You’re Closer Than You Think

Alysa and Wendell didn’t have a background in finance. They didn’t have fancy tools or a team of experts. What they had was a willingness to learn—and a system that made sense.

They stopped relying on generic advice. They took simple, strategic steps. And the results were life-changing.

You can do the same.

Make This the Year You Take Control

If tax season has always felt like something to dread, you’re not alone. But with the right mindset and support, it becomes a strategic advantage—not a source of stress.

Start small. Track your expenses for 30 days. Download the checklist. Read one chapter of the book. That’s all it takes to build momentum—and start saving.

You Don’t Need to Be Perfect—Just Take the First Step

Step 1: Download the Tax Preparation Checklist & Tax Write-Off Workbook to track and categorize your expenses with confidence.

Step 2: Order the on The Home-Based Business Guide to Write Off Almost Anything on Amazon that’s helped thousands of home entrepreneurs stop overpaying and start planning.

Step 3: Join the Home Business Tax Secrets Community membership for hands-on support and full access to my tax write-off system.

You don’t need to be perfect. You just need a system that works—and someone who’s been there.

Start With One Simple Change

Related Articles:

From Tax Confusion to Confidence for Home-Based Business Owners

Get expert tax guidance, tools, and support built for home-based business owners who want to stop guessing, claim every write-off, and stay audit-ready all year.

Inside the Home Business Tax Secrets Community, you’ll find proven tax strategies, practical templates, and real answers to the questions most accountants never take time to explain. You’ll finally feel organized, confident, and in control of your business finances.