Why Banks Misunderstand Home-Based Business Income (and How to Fix It)

Nov 09, 2025

You can have spotless credit, consistent income, and years of loyalty with your bank, yet still be turned down for a loan.

You can have spotless credit, consistent income, and years of loyalty with your bank, yet still be turned down for a loan. If that sounds familiar, you’re not alone.

Many home-based entrepreneurs learn the hard way that traditional banks weren’t built for people like us. The system was designed for employees, not business owners who manage their own income, work from home, and claim legitimate tax write-offs.

Time and again, I hear from entrepreneurs who feel blindsided by how lenders interpret their income for loan applications. It’s not that they’ve done anything wrong. It’s that the lending system was created decades ago for a world of predictable paychecks, not independent home-based professionals whose income can look different on paper from those who are employed.

The result? Lenders misread our financial story. They treat tax efficiency as financial weakness. And when the math doesn’t fit their formula, we get labeled as risky even when our businesses are strong and financially sustainable.

This article explains why that happens, how the system misunderstands self-employed income, and what you can do to make sure you’re seen accurately for the stability you’ve built.

The Real Problem Self-Employed Borrowers Don’t See Coming

When you apply for a loan as a home-based entrepreneur, the process looks very different from what employees face.

A T4 or W-2 employee walks in with a pay stub, a letter from their employer, and maybe one tax return. The bank plugs those numbers into a formula and gives an answer within minutes. For those who self-employed in a home-based business it’s a different experience.

We’re asked for two or three years of tax returns, profit and loss statements, bank statements, and sometimes explanations for every single income source. And that’s before the bank starts interpreting what those numbers mean.

Timing in filing your taxes can also play bigger role than most realize. Lenders review your last two years of income and often use the lower of the two if one has dropped. If you file taxes early and your most recent return shows lower income, that number can replace your stronger previous year.

If you’re planning a credit application early in the year, it can sometimes make sense to wait until your approval is secured before filing your taxes. Limiting some write-offs strategically in that year may help you qualify for the loan you need without compromising your overall tax plan.

Why Lenders See Self-Employed Income as Risky by Default

The issue isn’t always your financial habits or bookkeeping if you have that in order. It’s the banking system itself. Banks are built to prefer predictability. They see employment income as stable and self-employment as uncertain.

That assumption creates bias. Even when your business income is steady, lenders often assume it’s volatile simply because it doesn’t look identical each month or has some inherent risk involved. So when they calculate your loan eligibility, they use the most conservative interpretation possible.

In other words, they trust the calculation, not the person as an entrepreneur. From their point of view, it’s all about consistency of income source. Banks prefer W-2 or T4 slips because they can be verified instantly. When you’re self-employed, even a small year-to-year variation feels unpredictable to them.

That’s why even solid home-based businesses with proven cash flow are automatically viewed as higher risk. It’s not personal. It’s process.

A Real Example of How Banks Misread Self-Employed Income

I’ve seen this story play out for countless home-based entrepreneurs, and I’ve experienced it myself.

A few years ago, I applied for a small loan to buy out my vehicle lease. It should have been simple. I had strong income, spotless credit, and a long, positive history with my bank. Instead, the process turned into a series of repeated document requests far beyond what most self-employed borrowers are ever asked for.

They wanted multiple years of tax returns including profit and loss statements, and even explanations for specific income sources. It became clear that the issue wasn’t my numbers it was their lack of understanding of how a home-based business income actually works.

After more requests from the loan officer I decided to withdraw my application. Going through this process wasn’t worth my time. I later received an email from the branch manager asking me to reconsider. I replied saying the experience had made it obvious that the banking system simply hasn’t caught up with how modern home-based entrepreneurs earn and report income. She agreed saying the banking industry needs to evolve to better serve people like us.

That moment confirmed what I had already realized: the problem isn’t self-employed income. It’s how banks are trained to read it.

How Banks in Canada and the U.S. Treat Self-Employed Income

In both Canada and the U.S. banks rely on traditional income to debt formulas that favor employment income, but the tools they use in each country differ slightly.

In Canada, lenders use something called TDS, or Total Debt Service ratio that measures the percentage of your income that goes toward housing and other debts. For home-based sole proprietor loan applications, they use net income after expenses. So for example when you claim business-use-of-home and vehicle expenses you reduce your taxable income.

The TDS formula uses many of those expenses again in the calculation to determine how much you can borrow, even when you already accounted for a percentage of it as a business expense to determine your net income.

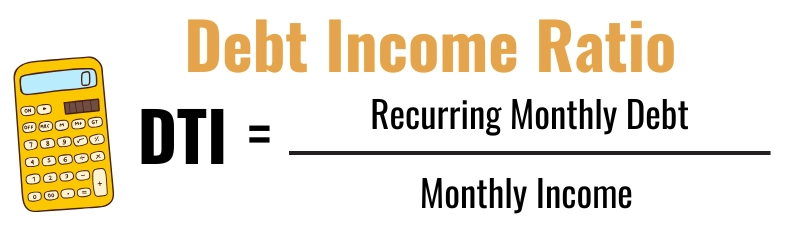

In the United States, lenders use DTI, or Debt-to-Income ratio. It works much the same way. If your Schedule C or 1099 income looks lower because of write-offs, your borrowing power shrinks.

Both systems miss the reality of how self-employed income works. Your deductions make you tax-efficient, not unqualified.

There’s also a key difference in how lenders treat business expenses. In the U.S., some conventional lenders will add back non-cash expenses such as depreciation or vehicle mileage when calculating qualifying income. In the U.S., depreciation remains one of the safest deductions because lenders can add it back as a non-cash expense.

In Canada, banks almost never do this as they use your net taxable income from your tax return and add-backs aren’t common. This leaves Canadian entrepreneurs with less flexibility, which makes organized records and well-timed tax filings even more important.

What Self-Employed Borrowers Need to Know About Loan Approvals

Why Declared Net Income Matters for Loan Approvals

Banks use your declared net income to decide how much you can afford to borrow. They don’t look at your gross income or consider the home-based expenses that naturally come with running a business from home like a portion of your rent or mortgage interest, internet, phone, or vehicle costs.

If your tax return shows $60,000 in net income after expenses, that’s the number they use. An employee earning $80,000 and paying similar living expenses looks stronger on paper, even though both have roughly the same financial reality.

This creates a quiet disadvantage for home-based entrepreneurs who use legitimate write-offs. You can appear less capable to lenders simply because you manage your finances wisely and pay less tax.

If your income varies from year to year, lenders often average the past two years or use the lower figure. That’s why planning ahead matters. Knowing your target income before filing can help you balance tax savings with borrowing power and avoid surprises when applying for credit or a mortgage.

The Double-Counting Trap That Shrinks Your Borrowing Power

When reviewing your file, lenders often misunderstand how home-based deductions work. They see them as business expenses that reduce income, then count them again as personal obligations in their debt calculations.

For instance, if you claim part of your rent, utilities, or vehicle for business use, those costs have already been deducted once. When the lender adds them back as personal expenses, it inflates your debt ratio and makes you look riskier than you are.

To prevent this, create a clear one-page summary. List your total business income, note which expenses have already been deducted, and separate your personal obligations. This helps lenders see the full picture and makes your financial story easier to understand.

Key Documents Canadian Lenders Want

If you’re self-employed in Canada, preparation and being organized with your bookkeeping is your best advantage as it’s easier for a lender to see your true financial story.

Most lenders will be looking for the following:

- Two years of T1 Generals and T2125 forms

- A recent Notice of Assessment from CRA

- A current profit and loss statement

- Proof of business registration or incorporation

- Recent bank statements showing consistent income

Optional but helpful: include a one-page summary that highlights your gross income, net income, and any business-use-of-home amounts already deducted.

If you’re incorporated, add a simple note or dividend summary to show how funds move from your business to your personal account. It helps the lender connect the dots between your tax return and your real income flow which can make your file easier to approve.

Key Documents U.S. Lenders Require

If you’re self-employed in the United States you will need to show a clear financial picture to prove income consistency. Here’s what most lenders will be looking for:

- Your last two years of Form 1040 with Schedule C (or Schedule E or F if applicable)

- Also Form 8829 if you claimed business-use-of-home expenses

- A copy of your year-to-date profit and loss statement

- Bank statements showing steady deposits and cash flow

- Business license or EIN verification

Some lenders may also request a business liquidity analysis if your company is incorporated. This confirms that your business has enough reserves to support your personal income. Ask your loan officer or broker if this applies to you so there are no surprises mid-application.

When possible, include a short explanation letter that clarifies how your deductions support your operations. This small step helps lenders see your business as stable, not uncertain.

Why It Helps to Have Clear Business-Use-of-Home Records

Your home office is part of your business, but most lenders don’t see it that way. They tend to treat home-based deductions as personal instead of business expenses.

Be sure keep detailed records and proof of regular business expense to show that your deductions are legitimate and already factored into your net taxable income.

This level of documentation builds trust. It not only prevents the double-counting issue that derails many applications but also positions you as an organized, credible borrower who understands how to separate business and personal finances.

Educating Your Lender Without Sounding Defensive

Clarity always wins over confrontation. Most lenders simply don’t understand how home-based self-employed income works, so your goal isn’t to argue it’s to guide the conversation and application process.

Bring a clean, organized summary that highlights your gross income, key write-offs, and real cash flow. It shows you know your numbers and builds trust right away.

You can say something simple like: “My income on paper looks lower because my business covers part of my household expenses. That’s standard under CRA and IRS business use of home tax rules. My real cash flow is shown here.” That single statement shifts the tone from defense to education.

If your net income fluctuations from one year be prepared to provide short explanation keeping it factual. The clearer your story is to the lender the more confidence your lender will have in you and your business.

Why This Matters Now for Self-Employed Borrowers

Automation is replacing conversations. Bankers often enter your numbers in the system and the algorithms decide who qualifies long before a human ever reviews your file.

This technology shift is why considering a mortgage broker who understands self-employed income could make all the difference as they understand the lending ratios and which lenders are best to approach that understand self-employed income.

Being self-employed doesn’t make you a higher risk. It makes you adaptable, resourceful, and capable. The challenge is helping banks see what you already know.

You can’t change how banks calculate risk, but you can control the story your numbers tell. When your paperwork reflects clarity and intention, the conversation shifts from “you don’t qualify” to “let’s find the right fit.”

Trade-Offs: Higher Rates, Bigger Down Payments, More Flexibility

If your bank still can’t see past its own model, you still have options. Credit unions, virtual banks, and non-traditional lenders often understand self-employed income better. They may accept shorter income histories or review business bank statements instead of full tax returns.

The trade-offs are usually modest:

- Offer higher interest rates

- A larger down payment (often 15 to 20 percent)

- Less automated approval and more human judgment

In Canada, alternate lenders such as Equitable Bank, Home Trust, and Duca specialize in working with self-employed borrowers. They often accept six months of business bank statements instead of two full years of returns. Rates are typically about one percent higher, and they charge a one-time lender fee of around one percent. In exchange, they may offer longer amortization periods sometimes up to 35 or 40 years and no mortgage insurance. For many entrepreneurs, this becomes a smart bridge strategy rather than a last resort.

In the United States, similar flexibility comes from portfolio lenders or non-QM programs that use bank-statement or P&L-based loans. These programs usually require larger down payments but are designed to recognize real-world income and business cash flow.

The goal isn’t to settle for any loan. It’s to find one that fits your financial reality while keeping your integrity and strategy intact. Once you understand your options and timing, the next step is mindset approaching the system with clarity and confidence instead of frustration.

From Problem to Path: Regaining Confidence with Your Financial Story

If you’ve ever been told you don’t qualify when you know you can afford the payments, you’re not alone. It’s frustrating when a system built for traditional employees can’t see the stability you’ve worked so hard to build.

The problem isn’t your numbers. It’s how lenders interpret them. Once you understand their process, you regain control. You can organize your records, tell your financial story clearly, and help lenders see the full picture instead of a limited snapshot.

That’s where confidence comes in. When your documents are organized and your explanations are simple, you stop feeling like you’re being judged and start leading the conversation.

The next step is putting that structure in place. Inside the Home Business Tax Secrets Community, you’ll learn how to document, organize, and present your financials with clarity so both you and the system finally see your business for what it really is: stable, credible, and ready to grow.

Tools, Support, and Next Steps to Take Control

You’ve seen how banks can misread self-employed income and how clarity changes everything. The next step is turning that clarity into structure so you can stay organized, audit-ready, and confident year-round.

That’s exactly what you’ll build inside the Home Business Tax Secrets Community. It’s not just another course. It’s a complete support system that helps home-based entrepreneurs stay organized, claim every legitimate write-off, and take full control of their business finances.

Inside the Community, you’ll get a series of guides that include:

- Bookkeeping Guide for Home Entrepreneurs so your records stay clean and ready for both tax filing and loan applications.

- Tax Preparation Guide to know when to file yourself, when to hire a CPA, and how to avoid costly filing errors.

- Schedule C Guide (U.S.): See exactly how to complete IRS Schedule C that lenders will be looking at.

- T2125 Guide (Canada): Understand how to properly report income and expenses for your small business.

You’ll get step-by-step guidance, hands-on support, and the proven system that helps home-based entrepreneurs stay organized, audit-ready, and financially confident all year long.

Take control of your business finances today. It’s time for the system to finally see what you’ve built. If you’re ready to go further, become a Home Business Tax Secrets Community member for all the insider support today.