Avoid These Audit Triggers: Bullet-Proof Your Tax Records Before It’s Too Late

May 18, 2025

Why Home-Based Business Owners Get Audited—and How to Stay Off the CRA or IRS Radar

Getting a tax audit letter from the CRA or IRS is enough to make any taxpayer anxious—but for home-based business owners, it can feel especially overwhelming. Whether you’re claiming write-offs on your T2125 or Schedule C, the idea of justifying your deductions to a government auditor can stir up serious stress.

In Chapter 18 of my book, The Home-Based Business Guide to Write Off Almost Anything, I introduced the concept of a desk audit and shared a real example from a member of our Home Business Tax Secrets Facebook community. That section was originally meant to include a full CRA audit questionnaire—but the chapter was getting too long. So I promised readers I’d publish that full content here.

If you're here after reading the book—welcome! You’re in the right place. This article will walk you through the actual Canada Revenue Agency (CRA) desk audit questions a home-based entrepreneur received, what each questions means, and how to prepare a response. Although this is a CRA desk audit, if you are in the US, there is no reason to think that the Internal Revenue Service (IRS) would not ask many of the same questions.

Why Record-Keeping Is Essential for CRA and IRS Audit Protection

While receiving a desk audit letter from the CRA or IRS isn’t something most home-based business owners experience regularly, it does happen—and when it does, it’s rarely at a convenient time. These letters are part of the government's routine audit process, and they’re often triggered by red flags on your tax return.

Some of the most common audit triggers include reporting high business expenses compared to your income, operating in certain industries flagged as high-risk, or inconsistencies in your documentation. That’s why it’s so important to keep your tax records bullet-proof and audit-ready—before a letter ever shows up in your mailbox.

I go deeper into these audit triggers and how to survive a CRA or IRS tax audit in Chapter 18 of my book, The Home-Based Business Guide to Write Off Almost Anything. That chapter, Surviving a Tax Audit, outlines how the system works—and how to defend your write-offs with confidence.

This article is your next step. Below, you’ll find a real-life example of a CRA desk audit questionnaire sent to a member of the Home Business Tax Secrets community.

As you read through the questions below, ask yourself: If I got this letter tomorrow, could I answer each question confidently? Are my records complete and organized?

If not—don’t worry. That’s exactly what this article (and my support system) is here to help with.

How to Respond to a CRA or IRS Desk Audit Questionnaire with Confidence

When responding to the audit questionnaire, it's important to read the questions carefully and provide accurate and complete information. Here are some tips to keep in mind:

- Understand the purpose of each question: Each question in the audit questionnaire is designed to help the IRS or CRA better understand your business operations and financial situation. Make sure you understand the purpose of each question before responding.

- Provide detailed and organized responses: When responding to each question, provide as much detail as possible and organize your responses in a logical manner. This can help demonstrate the legitimacy of your claims and make it easier for the auditor to understand your business operations.

- Use supporting documentation: Wherever possible, provide supporting documentation to back up your claims. This can include receipts, invoices, bank statements, and other financial records.

- Be honest and transparent: It's important to be honest and transparent when responding to the audit questionnaire. If you made a mistake on your tax return, it's better to admit it upfront rather than trying to hide it.

How Auditors Evaluate Your Home Business Write-Offs and Documentation

Accurate record-keeping isn’t just a best practice—it’s your first line of defense in a CRA or IRS audit. For home-based business owners, your ability to document business income and expenses clearly is what demonstrates legitimacy and protects your write-offs if you’re ever asked to justify them.

When you receive a desk audit questionnaire, the quality of your records can be the difference between a smooth resolution and a stressful reassessment. Organized receipts, mileage logs, income documentation, and time records show that your business is real, structured, and profit-seeking.

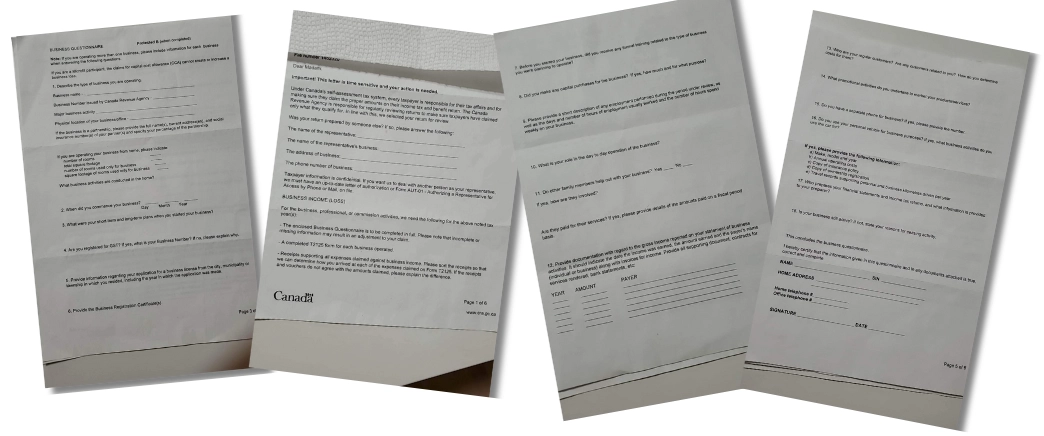

Back in late 2022, a member of my Home Business Tax Secrets Facebook Community reached out after receiving a letter from the Canada Revenue Agency (CRA). They were facing a desk audit. They shared the full audit questionnaire with me, and I walked them through exactly how to respond—what to say, how to explain their business activity, and why each question mattered.

Below, I’ve shared the actual CRA audit questions from that letter. While this list is based on Canadian tax review procedures, many of these same questions—and the reasoning behind them—apply equally to U.S. entrepreneurs being audited by the IRS.

You can also download a PDF version of the full questionnaire to review or print for your own records. Think of it as your home business audit preparedness checklist.

Strong Record-Keeping Can Save You in a Tax Audit

As you review the audit questions below, you’ll notice something important: these questions aren’t random. Whether it’s a CRA desk audit in Canada or an IRS inquiry in the U.S., each question is carefully worded to uncover key details about your business activity, income legitimacy, and the validity of your write-offs.

The language is specific, and the structure is intentional. Auditors are trained to ask questions that help them verify:

- Whether your home-based business is real and profit-seeking

- If your reported expenses are reasonable and well-documented

- How consistent your records are with the claims made on your return

Below, I’ve selected a few of the most common audit questions and broken down what the auditor is actually trying to confirm—and how your answers (and your records) can either support or hurt your case.

This behind-the-scenes look will help you prepare your responses strategically, stay compliant, and reinforce the legitimacy of your home-based business in the eyes of the CRA or IRS.

Business Desk Audit Questionnaire

Note: If you are operating more than one business, please include information for each business when answering the following questions.

Business Income (Profit/Loss): For the business, professional, or commission activities, we need the following for the noted tax year(s):

- The enclosed Business Questionnaire is to be completed in full. Please not that incomplete or missing information may result in an adjustment to your claim.

- A completed Statement of Profit and Loss form for the business.

- Receipts supporting all expenses claimed against business income. Please sort the receipts so that we can determine how you arrived at each of the expenses claimed. If the receipts do not agree with the amounts claimed on your tax return, please explain the difference.

- Describe the type of business you are operating: Business name, Business number, Major business activity, Physical location of your business/office

- If the business is a partnership, provide the full name(s), current address(es), and social security number(s) of your partner(s) and specify your percentage of partnership.

- If you are operating your business from home, please indicate: Number of rooms. total square footage, number of rooms used only for business. square footage of rooms used only for business.

- What business activities are you conducted in the home?

- When date you commence your business?

- What were your short-term and long-term plans when you started your business?

- Are you registered to collect sales tax? If yes, what is your business number? If not, explain why.

- Provide information regarding your application for a business license from the city, municipality or township in which you reside, including the year in which the application was made.

- Provide the business registration certificate(s).

- Before you started your business, did you receive any formal training related to the type of business you were planning to operate?

- Did you make any capital purchases for the business? If yes, how much and for what purpose?

- Please provide a short description of any employment performed during the period under review, as well as the days and number of hours of employment usually worked and the number of hours spend weekly on your business.

- What is your role in the day to day operation of the business?

- Do other family members help out with the business? If yes, how are they involved? Are they paid for their services? If yes, please provide details of the amounts paid on a fiscal period basis.

- Provide information with regards to the gross income reported on your statement of business activities. It should indicate the date the income was earned, the amount earned and the tax payer’s name (induvial or business) along with invoices for income. Provide all supporting documents, contracts for services rendered, bank statements, etc.

- Who are your regular customers? Are any customers related to you? How do you determine costs for them?

- What promotional activities do you undertake to market your products/services?

- Do you have a separate phone for business? If yes, please provide the number.

- Do you use your personal vehicle for business purposes? If yes, what business activities do you use the car for? If yes, please provide the following information: Make, model and year. Annual operating costs. Copy of insurance policy. Copy of ownership registration. Travel records supporting your personal and business miles driven per year.

- Who prepares your financial statements and income tax returns, and what information is provided to your tax preparer?

- Is your business still active? If not, state your reasons for ceasing activity.

Download a PDF version of these questions to print for your own use.

Insights Into the Business Desk Audit Questionnaire

As you read through these questions you will begin to notice that the requests to the taxpayer is very specific, targeted and strategically asked. Below I have selected a few of the questions to highlight some reasoning on these questions and what they auditor would be looking to verify from the response.

Question 3: If you are operating your business from home (# of rooms, square footage).

This question is being asked to help determine the legitimacy of your home office and the deductions claimed on the tax return. By asking about the number of rooms and square footage, the auditor can assess whether your home office meets the requirements for the deduction. In my book, Chapter 19 Business Use of Home, I go into detail on this calculation and the rules for claiming this as a tax write off. You can also learn more in my blog article How to Calculate Business Use of Home Expenses (Without Triggering an Audit).

Question 4: What business activities are you conducted in the home?

The question helps the auditor to understand the nature of your home-based business and its operations. This gives them the ability to know more about your "type of business" as they can then determine if your home office calculations and tax write offs claimed meet within the scope of that type of business.

As an example, if you are a freelancer doing gig economy work, and you are claiming 40% of your home as a square foot this might be out of proportion for that business type - considering the "office space" needed for that type of work.

For example, if you operate a graphic design business from your home, the IRS or CRA would want to know what specific activities you perform in your home office. This could include tasks such as designing graphics, communicating with clients, and managing your business finances.

Question 6: What were your short-term and long-term plans when you started your business?

By asking about your short-term and long-term plans, the auditor can gain insight into your goals and objectives of your business, as well as your strategy for achieving those goals. This information can help the auditor assess whether your business activities are legitimate and whether your expenses are reasonable and necessary for the operation of your business.

This is an important question especially when you would have employment income (W2 or T4) and therefore operate a home-based business on a part-time basis. Perhaps even more so when the home business does not generate a profit on paper and is used as a write off to being down your taxable employment. While this is a legitimate tax strategy, auditors will want to ensure your intentions are legitimate with a profit seeking intent. I go into much more detail on this in these chapters in my book, The Home-Based Business Guide to Write Off Almost Anything:

- Chapter 13: Part-Time Effort: Write Offs

- Chapter 14: When There's not Income/Profit

- Chapter 15: When a Hobby is a 'Business'

- Chapter 16: Demonstrating Profit Seeking Intent

It's important to provide honest and accurate information when responding to this question. If you did not have a clear plan or strategy when you started your business, it's better to be upfront about it rather than trying to fabricate a plan after the fact. Honesty and transparency are key to a successful audit.

Question 12: Please provide a short description of any employment performed during the period under review, as well as the days and number of hours of employment usually worked and the number of hours spend weekly on your business.

By asking for the days and number of hours of employment usually worked and the same for hours spent on business, the auditor can calculate how much time the taxpayer spends on their job versus in their home-based business. This information can help the auditor determine if the business has a legitimate focus with a profit seeking intent which is a justification of the business write offs claimed.

Keeping receipts may not be the most enjoyable task, but it's crucial to keep track of our profit-seeking business activities. As someone who values the use of notebooks, I believe they serve as a helpful tool for more than just record-keeping. They can also be used as a daily journal to prioritize tasks, record ideas and thoughts, and keep on track with core business activities by using calendars.

Record-keeping is an essential aspect of managing a home business, and it's necessary to ensure its success, as we'll see in the following discussion.

As a business, it's important to be on top of your financials including all those many tax write-offs we can take being home-based. Remember, the government knows that generally those in a home-based business, especially part-timers, are not the best at record keeping! According to the IRS and CRA, here are the top things that small businesses lie about on their tax returns:

- Underreporting income or failing to report all sources of income

- Overstating and/or claiming ineligible tax write offs

- Falsifying business activities to justify expenses

If you’ve followed my content for any length of time, you’ve probably heard me say this more than once: record-keeping is everything when it comes to audit-proofing your home-based business. It’s not just about tracking receipts—it’s about documenting your income, expenses, and the time you invest in running your business. And when it comes to a CRA or IRS audit, having 3–4 years of well-organized records can make or break your case.

That’s exactly why I developed the Home Business Tax Secrets Course & Productivity System—not just for others, but for myself. I’ve used this system every single month in my own home-based business since 2008. It’s helped me stay organized, defend write-offs during real audits, and maintain the kind of structure that gives peace of mind—not panic—at tax time.

If you're ready to take control of your tax strategy and want a record-keeping system that’s built specifically for home-based entrepreneurs, this is it. Inside the Community Membership, you'll learn exactly how to stay audit-ready, maximize your write-offs, and avoid the overwhelm that keeps so many entrepreneurs stuck.

Question 16: Who are your regular customers? Are any customers related to you? How do you determine costs for them?

The question is being asked by the auditor to determine whether the business is actually generating revenue from "real customers" and a fair market value, and if there are any potential conflicts of interest. For example, if the taxpayer is claiming expenses for services provided to a family member, the auditor may scrutinize the legitimacy of those expenses more closely.

If the home-based business cannot provide a clear and consistent method for identifying their regular customers (such as a customer list, market segment, etc.) and determining the customer price, this could raise questions about the legitimacy of the business enterprise.

Question 17: What promotional activities do you undertake to market your products/services?

This question builds on the answers provided in Question 16 above, as they auditor is looking for promotional activities to market the products/services. This then allows them to determine the legitimacy of the marketing related expenses and other business operating expenses like meals, entertainment and even vehicle mileage claimed. Additionally, the auditor may be trying to determine whether you have properly classified your expenses based on the answers provided.

The CRA and IRS are not there to judge the return on investment effectiveness or the tactics of your promotional activates, they are looking to ensure they are reasonable expenses for the type, size and opportunity with a profit seeking intent.

Question 18: Do you have a separate phone for business? If yes, please provide the number.

The question provides the auditor further insight into the business. For example, a separate phone number may verify the seriousness and separation of the business from ones personal life. It can also provide the auditor the ability to determine if the expense for this "business tool" is claimed appropriately, based on the other questions being asked.

As noted previously in this article, you can find more detail on these more detail on this in Chapters 13 through 16 in my book related to operating a part-time home business, not generating any income or profit, when a hobby is a business (or a business is really just a hobby) and how to effectively demonstrated "profit seeking intent".

Question 19: Do you use your personal vehicle for business purposes?

The question confirms if the home-based business owner is using personal vehicle for business purposes. It is not uncommon to use a personal vehicles for business-related purposes, such as meeting clients or delivering goods. However, it's important to track the mileage and expenses associated with this usage, as only the portion of the expenses related to business use are a tax write off.

If the auditor suspect something about the vehicle mileage claim, they may often request supporting documentation such as travel logs, insurance policies, and registration information to verify business usage of personal vehicles. To learn more about what is required, refer to Chapter 21 Your Personal Vehicle in the book, and in the Home Business Tax Secrets Course & Productivity System I have an entire module dedicated to becoming audit-proof in this area.

Question 20: Who prepares your financial statements and income tax returns, and what information is provided to your tax preparer?

The question provides insight into the preparation of the tax return(s) being audited. The auditor wants to know if the taxpayer used a professional tax preparer, and if so, what information was provided to the preparer. This helps the auditor determine if the tax return was prepared accurately and if any errors were made.

Additionally, this question may be used to identify any potential discrepancies between the taxpayer's records and the tax return prepared by the tax preparer. For example, if the tax preparer made errors or omissions on the tax return, this may lead to a discrepancy between the taxpayer's records and the return, which may be flagged during the audit.

Remember, at the end of the day the home-based business owner is responsible for the tax return, not the tax preparer. Often whatever you provided to your tax preparer is what they reported on your taxes. I go into more detail on this in the following chapters in the book:

- Chapters 8: Legally Minimize Your Income Tax Liability

- Chapter 9: Tax Season: Designed to Pay More Tax

- Chapter 10: Your Tax Preparer is Giving You Bad Advice

Build an Audit-Ready Tax Strategy—With Expert Support Every Step of the Way

Being proactive with your tax strategy isn’t just about avoiding penalties—it’s about gaining peace of mind, maximizing your write-offs, and finally feeling confident that you're doing it right. The truth is, most home-based entrepreneurs aren’t being shown how to stay audit-ready until it’s too late.

Inside the Home Business Tax Secrets Community, you’ll get the year-round guidance, tools, and real-world support you need to:

- Respond to CRA or IRS audit questions with confidence

- Keep bullet-proof records that stand up to scrutiny

- Know which tax write-offs you can legitimately claim

- Avoid the stress and second-guessing that keeps so many entrepreneurs stuck

Whether you’ve already received an audit letter or just want to stop feeling vulnerable, this Community is here to support you.

Join the Home Business Tax Secrets Community membership and take control of your tax strategy—before the CRA or IRS ever comes knocking.

From Tax Confusion to Confidence for Home-Based Business Owners

Get expert tax guidance, tools, and support built for home-based business owners who want to stop guessing, claim every write-off, and stay audit-ready all year.

Inside the Home Business Tax Secrets Community, you’ll find proven tax strategies, practical templates, and real answers to the questions most accountants never take time to explain. You’ll finally feel organized, confident, and in control of your business finances.