How to Calculate Business Use of Home Expenses (Without Triggering an Audit)

May 16, 2025

Have a home-based business and want to know all the deductions to which you are entitled?

Every tax season, I hear the same thing from home-based entrepreneurs—“I’m not sure if I can write off my home expenses,” or worse, “I’ve been too afraid to claim anything.” If that sounds like you, you’re not alone.

According to Forbes, 93% of self-employed business owners still miss out on legal tax write-offs—even when they have a paid tax preparer.

In both the United States and Canada, home-based businesses constitute a substantial portion of the 34 million small businesses in operation. According to the U.S. Small Business Administration and data from Statistics Canada, approximately 50% of all small businesses are operated from home.

The Business-Use-of-Home Deduction Is Often Misunderstood (and How to Get It Right)

This business use of home deduction is a powerful tool to reduce your taxable income—and it's absolutely legal when done correctly. But it’s also one of the most misunderstood by both home-based entrepreneurs and many tax accounts.

Some people guess their square footage. Others round up or rely on their tax software to catch everything. That’s where problems start—and where audit risk creeps in.

The truth? When you know the rules and have a system for calculating, documenting, and applying them, you’ll not only reduce your taxes legally… you’ll also gain peace of mind.

In this article, I’ll walk you through everything you need to know about business-use-of-home expenses, including how to calculate your percentage, what qualifies, what doesn’t, and how to keep it audit-proof. It’s time to start keeping more of your hard-earned money.

What Is “Business Use of Home”?

If you run a home-based business—whether part-time or full-time—in Canada or the U.S., there’s a powerful tax write-off you may be overlooking: business-use-of-home expenses. Both the CRA (via the T2125 form) and the IRS (using Schedule C and Form 8829) allow you to claim a portion of your home expenses if you use part of your home regularly and exclusively for business.

What Does “Exclusively and Regularly” Mean?

This is where most people get tripped up.

- Exclusively means the space is not used for anything else. It’s not your dining table, your couch, or your spare bedroom with a guest bed. It must be dedicated to your business.

- Regularly means consistent use—not once a month or during tax season only. This needs to be your principal place of business, or where you meet clients or store tools, inventory, or business materials.

If you're coaching clients from your converted den, shipping products from your basement, or storing your landscaping equipment in the garage—this could qualify. But you need to get the record keeping right.

What Can You Write Off?

If your space qualifies, you can write off a portion of the following expenses:

- Rent or mortgage interest (not principal)

- Heat, electricity, water

- Home insurance

- Property taxes (Canada only)

- Depreciation (U.S. only)

- Repairs and maintenance that apply to the home as a whole

Two Ways to Calculate Your Deduction

1. Simplified Method

Flat rate per square foot (e.g., $2 per sq ft in the U.S. up to 300 sq ft; Canada offers a similar method capped at $500 per year). This is easy—but often leaves money on the table.

2. Actual Expense Method

You calculate the percentage of your home used for business and apply that to eligible expenses.

I almost always recommend the actual method. It takes a little more effort, but the deduction is usually significantly larger—especially if your bookkeeping is in order.

How to Calculate Your Business-Use Percentage (The Right Way)

This is where many home-based entrepreneurs either overestimate, underestimate, or avoid the deduction entirely because they’re not sure how to do the math. But the CRA and IRS both use the same basic formula—and once you understand it, it’s simple.

The Formula Used by CRA and IRS

Business-use square footage ÷ Total home square footage = Business-use percentage

Let’s break it down with a real example:

- Your home: 1,800 sq ft

- Dedicated office: 120 sq ft

- Garage: 200 sq ft (70% used for business storage)

Here’s the math:

120 + (0.70 × 200) = 260 sq ft of business-use space

260 ÷ 1,800 = 14.4%

That means 14.4% of your actual home expenses can be written off—including utilities, rent or mortgage interest, insurance, and more (based on CRA or IRS guidelines).

This is not a guess. It’s a documented calculation. And when you’re audit-ready, it makes all the difference.

Mixed-Use Spaces: What to Know and How to Justify Them

This is where things get a little more nuanced—and where most tax software and even some accountants fall short. If you’re using part of your home for business but it also serves a personal purpose, you’re dealing with what CRA and IRS call mixed-use space. The good news is: if you track it and use the right method, you can still claim it—legitimately.

Let me share a real example.

A reader of my book The Home-Based Business Guide to Write Off Almost Anything recently reached out to ask me a question. He runs a landscaping and lawn care business and had a question about storing his trailer and equipment in his garage. His HOA doesn’t allow him to park in the driveway, so he keeps everything in the garage with 70% of the garage is used exclusively for business.

He wanted to know: Can I write this space off?

Yes—if the garage is attached to your home, and you’re using part of it regularly and exclusively for your business (like storing equipment, supplies, or inventory), you can include that space in your business-use-of-home percentage.

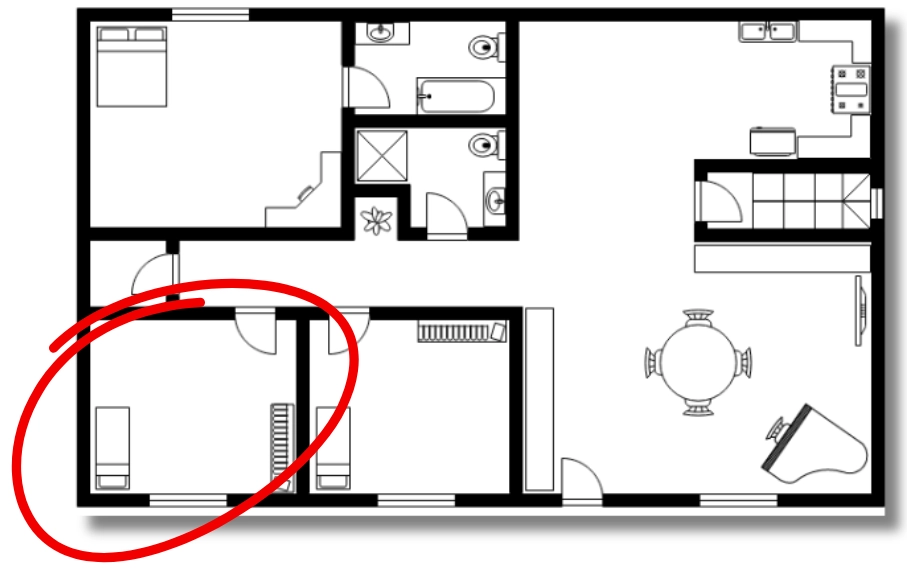

Here’s how I explained it to him to calculate the business use of home portion including the garage:

- Measure the square footage of your garage.

- Take 70% of your garage’s square footage (the portion used for business).

- Add that to the square footage of your home office space (that we calculated earlier).

- Divide the total by your home’s full square footage including your office and garage.

- Apply that percentage to eligible home expenses on your taxes when using Form 8829 (U.S.) or T2125 (Canada).

This approach gives you a legitimate percentage that reflects how much of your home is truly supporting your home business, in this case it was a lawn care business. I suggested that it’s a good idea to sketch or photograph the setup—something as simple as a floor plan can help back up your square footage claim if it's ever questioned. As a word of caution, if the garage is detached, it’s not considered part of the home and needs to be handled differently.

Audit-Proof Tips and Strategies: Protect Your Home Office Deduction

Many home-based entrepreneurs aren’t audit-ready when it comes to the home office calculation—not because they’re doing anything wrong, but because they can’t clearly prove how they came up with their numbers. That’s where documentation matters just as much as the deduction itself.

Whether you're filing in Canada (using the T2125 form) or in the U.S. (using Schedule C and IRS Form 8829), the basic recordkeeping principles are the same.

Here’s what I recommend:

- Sketch Your Workspace: Use a simple sketch or floor plan of your office area. Label the dimensions. If you’re including your garage or shared space, mark that too. Bonus: take a few clear photos showing your desk, setup, or storage.

- Track Bills and Receipts: Keep copies of your utility bills (heat, electricity, water), internet, rent or mortgage interest, repairs, and insurance. Use a folder system—digital or physical—and label them by month and category.

- Update Your Calculation Annually: If you move, renovate, or change how you use your space, recalculate your business-use percentage for that tax year. CRA and IRS expect accurate numbers based on your actual situation—not a guess from two years ago.

- Document Everything: Keep a “home office folder” that includes your square footage calculation, photos, floorplans, receipts, and any notes or logs about your space. It doesn’t need to be fancy—just complete.

- Avoid Estimates or Rounding Up: If your office is 112 square feet, don’t call it 150. This is where people get into trouble. Round numbers look suspicious, especially when they always seem to benefit you.

These are simple steps, but most entrepreneurs never take them. That’s what puts your return at risk—not the deduction, but the lack of backup.

Can the Home Office Deduction Create a Loss?

A question I get asked often is whether the home office deduction can be used to create a business loss—especially for sole proprietors who also have full-time employment income. The short answer is: no, you can’t use the business-use-of-home deduction to create or increase a business loss.

Whether you're in Canada or the U.S., both the CRA and IRS follow the same basic rule: You can only deduct home office expenses up to the amount of net business income you earned for the year.

Here’s What That Looks Like:

-

You earn $5,000 in net business income after expenses

-

Your home office expenses total $6,000

-

You can only claim $5,000 of those expenses this year

-

The unused $1,000 carries forward to the next tax year

That carry-forward doesn’t expire—it rolls over and can be applied when you have higher profits. But here’s the catch: keep a clear record so you don’t forget about it in future years.

Why Your Tax Preparer Might Be Missing Deductions

You’d think hiring a tax professional means everything is covered—especially something as common as home office write-offs. But I’ve seen the opposite more times than I can count.

Many tax preparers don’t ask about partial-use spaces like garages, storage rooms, or basements. Most tax software doesn’t prompt you either. And if you don’t bring it up, they may default to the simplified method or counting rooms—which is easier for them, but often leaves money on the table for you and in a potential audit risk.

Most accountants and tax preparers are generalists. They are focus on filing tax returns—not to dig into every deduction that applies to home-based entrepreneurs like you.

So here’s something to think about: Is your tax preparer proactively advising you on write-offs—or just processing your paperwork?

You don’t need a $300/hour accountant to get this right. You just need to know what qualifies, how to calculate it, and how to back it up. When you have that knowledge, you can confidently bring these deductions forward—whether you’re filing solo or working with a pro.

Stop Guessing. Start Claiming What You're Owed.

The business-use-of-home deduction is one of the most overlooked tax write-offs for home-based entrepreneurs. Most people skip it—or get it wrong—because no one’s shown them how to apply it properly.

But now you know what qualifies, how to calculate your percentage, and what to document.

If you're ready to stop leaving money on the table, the Home Business Tax Secrets Community membership gives you:

- A full course on tax write-offs and audit-proofing

- Step-by-step home office, vehicle, and travel guides

- Downloadable tools and checklists

- Year-round support so you're never stuck

Take the stress and second-guessing out of your taxes—get tools, guidance, and peace of mind.

Home Office Deduction FAQs

Q: What if I’m a gig worker who does deliveries—can I still claim business-use-of-home?

Yes—if you use part of your home to manage your delivery business (e.g., tracking mileage, storing delivery bags, maintaining records, charging devices), and that space is used regularly and exclusively for those tasks, it can qualify. You don’t need to meet clients at home—you just need legitimate business activity tied to your home workspace.

Q: What if I move during the year or change rooms in my home to have more business space?

You’ll need to prorate your business-use percentage. Calculate the square footage and time used in each location or room, and keep notes showing when the change occurred. CRA and IRS both expect year-specific calculations—so track it properly, and you can still maximize the deduction.

Q: What if my office is 50% or more of my home? Is that an audit risk?

Technically, there’s no upper limit on the percentage—what matters is that it’s accurate, justified, and used exclusively for business. That said, claiming over 50% of your home often raises red flags. If your entire basement or multiple rooms are dedicated to your business, document it carefully and be prepared to explain it.

Q: What if I have seasonal income and don’t work part of the year?

You can still claim the deduction for the months your home office is used regularly and exclusively for business. Just prorate your expenses accordingly. This is common for coaches, consultants, and gig workers who scale up during busy seasons and pause during others.

Q: Can I claim business-use-of-home if I rent?

Absolutely. You don’t need to own your home to claim this deduction. If you’re a renter, you can deduct a portion of your rent, utilities, and other eligible expenses based on your business-use percentage—just like a homeowner.

From Tax Confusion to Confidence for Home-Based Business Owners

Get expert tax guidance, tools, and support built for home-based business owners who want to stop guessing, claim every write-off, and stay audit-ready all year.

Inside the Home Business Tax Secrets Community, you’ll find proven tax strategies, practical templates, and real answers to the questions most accountants never take time to explain. You’ll finally feel organized, confident, and in control of your business finances.